Search for Topics

-

Investment Memos highlight the distinction between well-considered financial decisions and hasty gambles. This unassuming yet powerful tool is pivotal in crafting a disciplined investment strategy, one that is guided by clear governance and a consistent decision-making process. Rather than by…

-

How Often Should Investors Review Their Portfolio?

How often should investors review their portfolio? And, when does it become too much or too little? Researchers have discovered that acting on a schedule with surprisingly long intervals is more sensible, even when transaction costs are low. In other…

-

Values Based Wealth Management

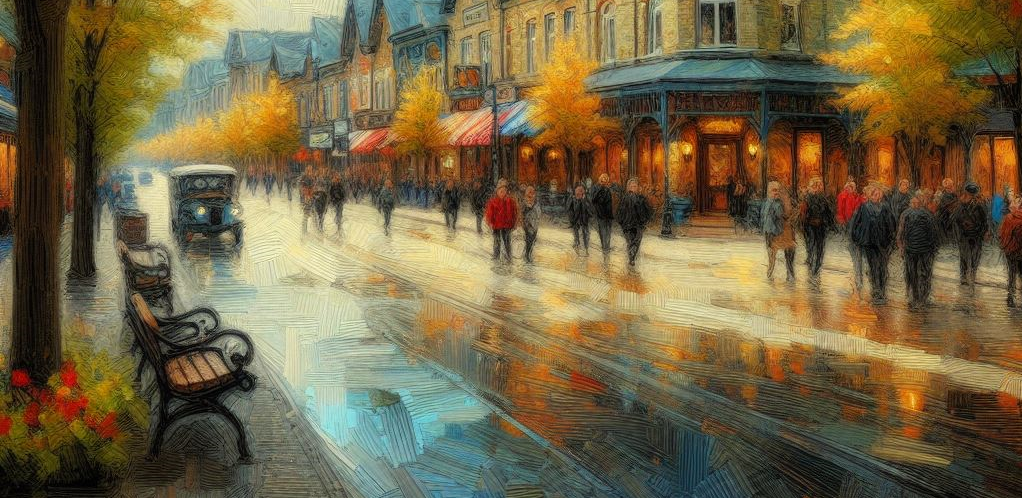

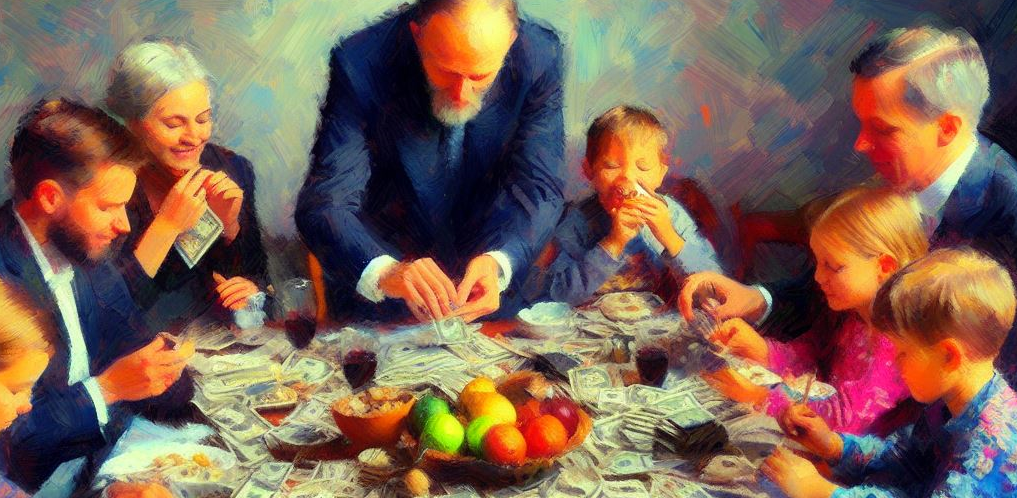

Managing and transferring wealth across generations is a formidable challenge. And often, the most important element is the perspective of the family members, rather than any specific investment strategy. So, at our family office, we understand this journey is about…

-

Family Meetings for Wealth Management Success

Within wealth management, family meetings have emerged as a valuable tool for generational wealth transfer. Through our family office, we’ve seen a growing number of clients harness the power of family meetings to prepare their next generation for the responsibilities…

-

Six Ways to Amplify Your Foundation’s Impact

To improve impact, it’s crucial that all charitable foundations continuously refine their approaches to increase their efficiency. Here, are six strategies to help your foundation amplify its impact: 1. Measure: Choose Metrics and Collect Data Just as businesses gauge their…

-

Empowering Charities: Bookkeeping for Charitable Foundations

Bookkeeping for charitable foundations isn’t just a good practice—it’s pivotal. And thankfully, efficient bookkeeping for your charitable foundation can be easy. But for success, you need a partner who understands the specialized demands of charities to ensure your foundation maintains…

-

Multi-Generational Wealth Management: Strategies for Success

When it comes to multi-generational wealth management, is financial wealth the only capital worth cultivating? While financial capital is significant, considering various aspects of capital, including human capital and leadership, is essential to successfully transition wealth across generations. This post…

-

Succession Planning for Private Foundations & DAFs

Private foundations are a popular avenue for many high net worth individuals who want to actualize their philanthropic ambitions. In Canada, we have over 6,000 registered private foundations and many more donor advised fund (“DAF”) accounts. But, while setting up…

-

Simplicity and Success: The Power of Buy-and-Hold

In the ever-evolving world of investment strategies, it’s easy to get lost amidst the myriad of complex theories and tactics touted by experts. Yet, time and again, history has shown that there’s profound strength in foundational principles. At the heart…

-

Buy-And-Hold Investing: A Forever Strategy?

In the era of digital trading platforms and zero-commission brokers, investors have never had it easier. With tools at our fingertips and little to no fees, we have the luxury of making stock market investments efficiently. However, with all these…