Mastering Wealth Stewardship: Strategies for Success

We’ve all come across the adage, “With great wealth comes great responsibility”. It’s not just a throwaway phrase but carries profound wisdom, especially for those who have been fortunate enough to accumulate substantial assets. Successful wealth stewardship is challenging. So, this post will offer both wealthy parents and their next-gen heirs with some tips to help them achieve success.

Before we begin, let’s put your financial knowledge to the test. Try out our free financial literacy quiz and see how you stack up!

A Personal Journey Towards Wealth

In my 20s, I embarked on a wealth journey that saw me take a regular income and turn it into fruitful investments. From accumulating a portfolio of condos in bustling downtown Toronto, delving into blue-chip stocks that churned out robust dividends, to dabbling in the digital currency world with bitcoins & Ethereum during their infancy, my financial graph saw an upward trajectory.

However, as I gained more financial success, my perspective began to shift. I realized that my life should be more than simply accumulating material resources. Instead, my focus should be on helping those I can reach the most while balancing my personal and professional pursuits. I made the transition from working as an investment advisor to establishing a family office for this purpose. It was a conscious choice, driven by a desire to provide personalized management and administrative services to a few hand-picked clients. At this point in life, it would have been easy to coast. After-all, my economic foundations were secure, and I could be free to pursue a life of pleasure.

The Perils of Inactivity

However, upon my exit from a life as an investment advisor, several seasoned professionals shared the same piece of invaluable advice with me – to keep working. While wealth provides comfort, inactivity can lead to a purposeless existence. The essence of life is in striving towards goals, providing direction and nourishment to the soul. I began to see the same phenomena with my own clients. An idle life is not fulfilling. And so, I began to wonder whether more wealth was better than less. Or, whether providing the wealth management tools to the next generation is more important than providing them with financial capital.

Understanding “The Good Life”

Contrary to popular belief, a good life isn’t defined by hedonism. It’s not about maximizing pleasure. Instead, it is marked by good health and making a meaningful impact on the people and causes dear to you. For those with wealth, one of the main challenges is ensuring the next generation can continue to build upon your foundation. For next-gen inheritors, the main challenge is learning how to take responsibility for it.

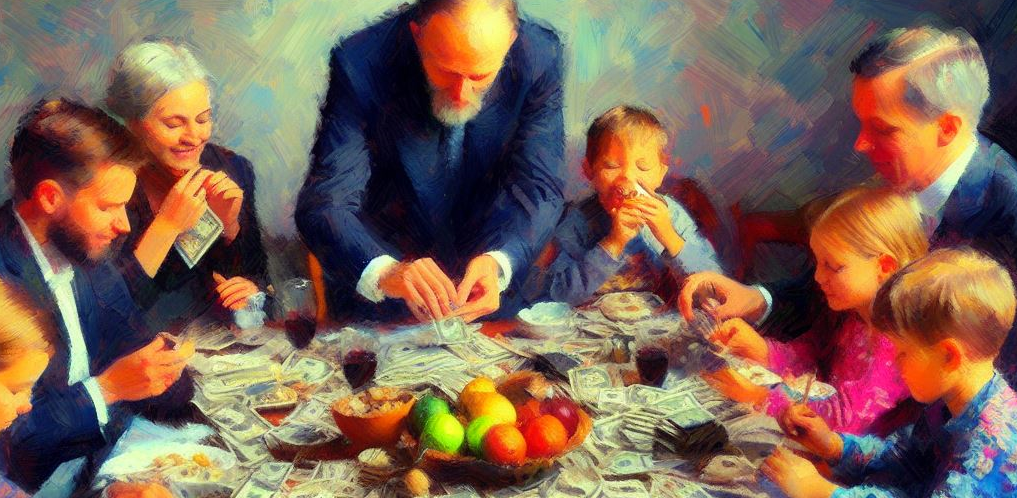

The Dangers of Unchecked Wealth

For this reason, wealth without responsibility, can be a treacherous predicament. I’ve seen wealthy inheritors, unaccustomed to handling it, fall victim to their good fortune. Instead of making well-informed decisions, they tend to outsource decision-making and indulge in what’s commonly known as “the good life”. Or, they become overconfident and make decisions without being fully informed. Eventually, their poor decision making catches up to them, and it only becomes apparent by the time its too late.

Wealth Stewardship: Crafting a Solution

- Marrying Wealth with Responsibility: Wealth shouldn’t just be about accumulation but also about how it’s wielded. It demands active management, continuous learning, and a sense of responsibility.

- Educating the Next Generation: Don’t just bequeath assets. Pass down a structured wealth management process. Equip them with the skills to handle emotional challenges like guilt, anxiety, or shame that often accompany inheritances.

- Rethinking Wealth Distribution: Is there an ideal inheritance amount? While this varies for every family, leaving a colossal sum may not always be the best choice. If your net worth significantly surpasses that of an average retired professional, consider philanthropy or establishing a family foundation.

- Evolving Estate Plans: Your estate plan shouldn’t just be a dormant document, but an evolving blueprint. The transition of wealth and wisdom should occur while you’re alive, preparing the next generation for eventual responsibilities.

- Finding a Purpose: Beyond wealth, what is your purpose? How are you making a positive impact on the world around you?

Actionable Tips to Prepare your Heirs:

- Regular Family Meetings: Regular dialogues can bridge understanding and clarify expectations. Include multiple generations and allow a professional working for the family to facilitate these sessions.

- Transition Assets & Responsibility: Begin the transfer while you’re around to guide and mentor the next generation. Share responsibility with the next generation so they can learn from your experience.

- Empower the Next Generation: Allow them to make decisions, take risks, and learn. Allow the next generation to feel pride of ownership.

- Constantly Evolve Your Team: A dynamic team can infuse fresh perspectives and strategies. As the years pass, allow your professional advisors to grow as well.

Actionable Tips for Next-Gen Inheritors

- Gain Financial Literacy: This is the cornerstone. Understand basic financial concepts, such as the time value of money, compound interest, asset allocation, and risk management.

- Mentorship: Learn from the current wealth holders or their trusted advisors. This hands-on experience is invaluable. Being involved in family financial discussions, decisions, and even mistakes can be very educational.

- Practice with You Own Portfolio: Regardless of whether your parents give you any financial support or assets to manage. Nowadays its easy to open a brokerage account and get started on your own. Do some research online and find a commission free brokerage that may also provide fractional share ownership. This way, your financial commitment can remain small while you gain experience. Share your experience with your other family members. Wealthsimple, National Bank Discount Brokerage, TD Easy Trade.

- Find Ways to Contribute: Whether its by sitting in on your family’s various investment committee meetings or reviews with their advisors. Ask for opportunities to contribute and don’t expect anything in return.

- Emotional Preparedness: Wealth can be as much an emotional responsibility as a financial one. It’s crucial to develop resilience, discernment (especially when approached for financial favors or investments), and a clear understanding of one’s values and priorities.

- Establishing Personal Goals & Vision: Understand what you want to achieve with the wealth you plan to inherit. Whether it’s philanthropy, growing the assets, or sustaining a certain lifestyle, having clear objectives will guide financial decisions. Write your values & goals down!

- Create a Family Mission Statement: If one doesn’t exist, this document can outline a family’s values, goals, and responsibilities relating to wealth. It can act as a guiding principle for current and future generations.

Navigating Your Wealth Legacy with Markdale Financial Management

While the journey of wealth accumulation and legacy is technically complex and full of emotional baggage, it need not be navigated alone. Markdale Financial Management stands as a beacon for those seeking expert guidance on wealth transition. With a suite of services tailored to address the intricacies of financial planning, Markdale not only understands the challenges faced by wealthy families but also provides holistic solutions. Our services are dedicated to ensuring a seamless and informed transition of your wealth to the next generation.

If you are interested in joining our network, contact us or fill out this free assessment questionnaire to determine if our family office services can help you efficiently manage your wealth!

Don’t forget to subscribe to our free newsletter for valuable insights delivered monthly.

Leave a Reply