How Much Does Wealth Management Cost?

Cost is an important factor when considering how to create your Wealth Management Process. This post compares the costs and benefits of using a family office to for your wealth management and describes real scenarios of how this is done.

Who are the fees paid to?

There are a few different service providers that will charge you fees to manage your wealth. Using an investment advisor, an accountant, a lawyer, a banker, and a family office are all expenses. Banking fees are relatively minor for wealthy families, but fees for investment advice are commonly high. The fees for tax (accounting) advice and administrative support (family office) fall in the middle.

Investment Advice

How much you pay for investment advice makes all the difference to the overall cost of managing your wealth. The fees paid to investment advisors represent by far the largest portion of overall management costs for wealthy families.

The fees investors pay for investment advice changes based on the type of investments held and the size of the portfolio being managed.

Investments traded on stock exchanges, commonly referred to as public equities, are the cheapest investments to manage. Stocks are liquid, and prices are transparent. This means there’s less an investment advisor can gain through their active management. Plus, the market for advice about stocks is competitive and this keeps the price for this advice in check.

Private equity management fees are much higher by comparison. These fees can range from 1% to 2% per year plus performance fees. Many private equity funds charge 2% per year plus 20% of any gains past a hurdle rate. These types of fees are also commonly charged for funds making “impact” investments with social & environmental goals.

Investment management fees for real estate investments also vary widely. Some Real Estate Investment Trusts (REITs) traded on stock exchanges typically have very low fees, whereas some private real estate funds charge similar fees as other private equity funds.

Managing your Investments: the choices

At one extreme, a DIY investor can use a discount broker and pay almost no fees other than a trickle of commissions each year. At the other extreme, investors might pay up to 1% of the value of their portfolio each year in fees for investment advice. In Canada, investors with more than $10 million in their portfolio can probably negotiate a 0.50% annual fee for a stock portfolio, and investors with over $100 million should be able to get their annual fee closer to 0.25%.

Considering how asset allocation and investment style makes the difference between paying high fees and paying low fees for investment advice, an investment policy that calls for a balanced portfolio between some public equities, private funds, impact investments, and real estate will pay higher fees than one focused only on public equities.

How much investors pay for advice will highly influence the overall cost of their wealth management.

How much for an accountant?

Compared to investment management fees, the cost for accounting service is much easier to navigate. Accountants generally charge for their time. So, if your file is complex and time consuming, your accounting fees will be higher.

The best way to reduce accounting fees is to simplify your structure and reduce complexity. For example, can you reduce the number of holdcos you have or can your family office shoulder some bookkeeping that will make your accountant’s life easier? Cross border tax issues and trusts also add tax compliance burdens so consider ways to reduce these.

Click here to read my post on Getting the Best from your Accountant.

How much for a lawyer?

Legal fees can add up, but there are straightforward ways to manage these expenses too. Each of us needs a will & estate plan. We also need to update our will & estate plans periodically as life circumstances change. For a wealthy family, this is a cost that is tough to avoid since mistakes made by not adequately planning for your estate may cost your heirs much more than the cost of legal advice.

But, legal costs can be reduced in the same ways accounting costs can. Simplifying your holding structures and using a family office will reduce legal costs.

Many wealthy people use their lawyer’s office address as the mailing address for public filings (such as the address for their charitable foundation), and this adds a few thousand dollars per year to legal fees. Consider forwarding mail from your lawyer’s office and your home to your family office where it can be captured and filed on a consistent basis.

How much does a family office cost?

Another wealth management cost centre is general administration which is provided by your family office. These costs include paying for office supplies, a shared drive for document storage, bookkeeping, report generation, tax prep, and mail forwarding. Some families also maintain separate e-mail addresses for their business correspondence and a website for their family foundation.

Your family office will typically fill in the gaps between what your other advisors can’t do. Some family offices also manage their investments in house.

What about your banker?

Banking fees make up a small portion of overall cost. Many wealthy families use private banking services which generally cost $150 per month. This gives the client access to a dedicated team of bankers that are usually much more responsive and knowledgeable compared to run-of-the-mill branch staff. Having private bankers reduces the time clients might need to deal with a 1-800 number and makes it much easier to send & receive payments.

Many private bankers also offer bill payment services. This means that your bills can be forwarded to your private bankers where they can make payments on your behalf. Today however, its pretty simple to setup most bills to be paid automatically by a credit card.

The way you structure your wealth management process will determine the overall fees that you pay.

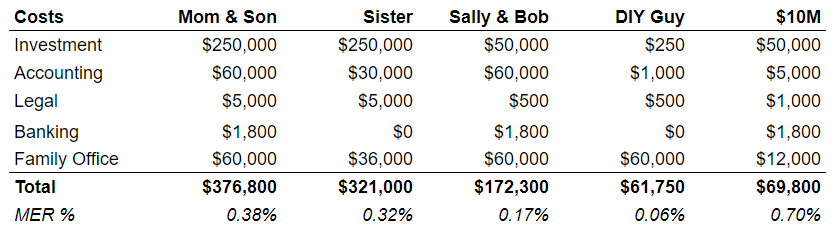

Let’s consider four different ways to structure your wealth management and compare the costs & benefits. Each scenario described herein assumes a net worth of $100 million.

These scenarios use round numbers and make assumptions about the nature of income (interest, dividends, capital gains) and their associated tax rates. For example, at the time of writing, the dividend yield on the TSX/S&P 60 Index is 2.50%. But there is wide variation between stocks such as the largest company in Canada, Royal Bank of Canada, which pays a 4% dividend and the second largest company in Canada, Shopify, which pays no dividends. The same is true of real estate and private equity. Each investor’s asset mix and desire for income will vary based on their own goals.

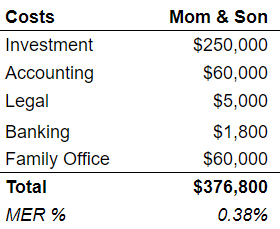

Mom & Son

In a previous generation, an entrepreneur built and sold a business, then left his daughter with a holdco containing a blue-chip stock portfolio now worth $100 million. Over the years, the daughter became a mom and now has an adult son and grandkids of her own. The mom & son manage their wealth together and use a family office for administrative support. Their investment policy calls for a portfolio of dividend producing blue-chip stocks and a 10% allocation to impact investments.

The mom & son outsource investment management of public equities to an investment manager who charges them 0.25% per year. They use their family office to source impact investments, generate quarterly reports, hold a quarterly meetings, receive mail and file documents, keep the books for their holdco and family foundation. Their family office also co-ordinates filing of their tax returns with their accountant.

An accountant prepares tax returns each year for their personal, holdco, and family foundation. Their tax complexity is a little more burdensome because of the impact investments they make. The mom & son consult with their lawyer every few years to update their will & estate plans as their life circumstances have changed.

Here’s what it costs:

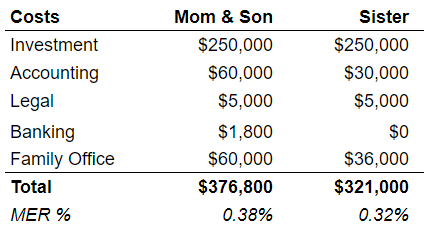

Sisters

Tragically, when two sisters were young adults, their father died. However, their father’s estate left them an inheritance of $5 million and a buy-sell agreement left the father’s share of his business to his business partner. Over the years, the sisters lived a frugal lifestyle and have grown their investment portfolio to $100 million by using a simple buy-and-hold approach. Their investment policy calls for holding their entire portfolio in blue chip stocks which are managed by their investment advisor for a 0.25% annual fee.

The sisters use a family office to do their bookkeeping, receive & file their mail to a shared drive, and prepare quarterly reports for them which they review quarterly with their family office advisor. Their accountant prepares their personal tax returns. The sisters use a donor advised fund for their philanthropy. The sisters keep their financial affairs simple and do not use private banking. They receive comfort by using their family office and their investment advisor as sounding boards.

Here’s what is costs:

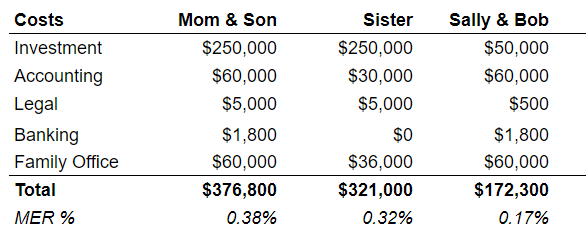

Sally & Bob

Sally & Bob are retired entrepreneurs. They built a software company that went public then sold to a larger competitor and cashed out for $100 million. Sally & Bob like to call their own shots, but don’t enjoy doing administrative tasks. They prefer to outsource as much administration to their family office as possible including bookkeeping, record keeping, and report generation. Sally & Bob continue to invest in private equity. Their private equity investments add a layer of complexity for their family office to keep track of and for their accountants to provide them with advice about.

Sally & Bob’s investment portfolio contains a mix of private equity and public stocks. They hold their stocks in a discount brokerage account and they use their family office as a sounding board, but ultimately make their own investment decisions. The fees they pay for investment advice are limited to the private equity funds they hold and some ETFs that are part of their stock portfolio.

Sally & Bob also lean on their family office to help them supervise some of the private businesses they own and ensure their family foundation remains compliant.

Here’s what is costs:

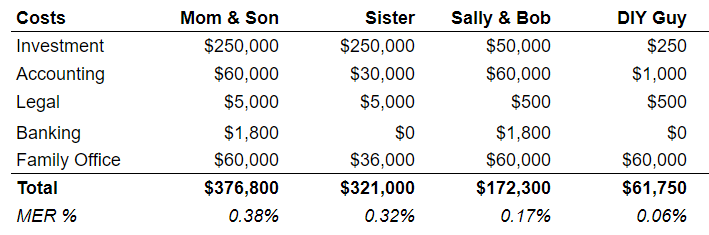

DIY Guy

DIY Guy is a hardcore entrepreneur who likes to be in charge and call his own shots. He thinks paying for investment advice is foolish when he can simply hold a diversified portfolio himself. He does this inside a discount brokerage account which now totals $100 million. DIY Guy’s investment policy calls for a portfolio containing blue-chip stocks, REITs, and some fixed income. He uses a family office to receive and file his mail to a shared drive. And also to do his bookkeeping, prepare quarterly reports of his portfolio, assist managing a 10-unit apartment building, and as a sounding board.

DIY Guy files his own tax return for himself, his family, and his charitable foundation. He does this by coordinating with his family office advisor. DIY Guy has an up to date will & estate plan prepared by his lawyer that leaves his estate to his two children in trust with the trustee being his family office advisor.

Here’s what is cost:

Comparing the Four Scenarios

The most important lesson from the four wealth management scenarios that I’ve described above is that not one way is best. The Wealth Management Process that anyone might choose depends on what your values are and what your financial goals are. A good family office advisor will help you outline your values and determine your financial goals, and these will become the foundation of how your Wealth Management Process is structured.

Your personality matters as well. If you’re someone who has fun analyzing the business environment and picking stocks, then your Wealth Management Process will be different from someone who would rather avoid stock picking.

The universal truth about all client scenarios described in this post is their desire to outsource administrative tasks to their team of professional advisors (their accountant, lawyer, and family office). Wealthy people have the advantage of being able to save time (which is everyone’s most valuable resource) and increase efficiency by outsourcing their administrative tasks. Successfully managing wealth involves supervising and nurturing a team of professional advisors.

Wealth Management Costs

How do the choices we make about how to manage our wealth influence our net income? What are the pros and cons?

Investment Style Matters

In our four scenarios, Mom & Son pay the most fees at $375,000 per year. Two thirds of their expenses come from investment management. What if they paid 0.50% instead of 0.25%? In this case, the portion of their total expenses attributed to investment management would rise to 80%. Whereas Sally & Bob only pay one third of their total expenses to investment management fees. Because, they take most of the responsibility over investment decisions themselves.

Mom & Son don’t need to worry at all about investment performance or investment decisions because they have outsourced those decisions to an investment advisor. This gives them peace of mind and ensures their investment performance matches their objectives. Since they shoulder the responsibility themselves, Sally & Bob are burdened by the performance of their investment portfolio. Their returns have suffered because investing bias often creeps into their decision making.

Portfolio Composition

Sally & Bob have also sacrificed some income because they invest in private equity. Their private equity investments do not pay dividends like their stock portfolio does. Another draw back to their strategy is higher accounting fees. And, more time spent coordinating administrative tasks with their family office. Not to mention the extra time it takes to supervise a portfolio of private businesses including board meetings, etc.

The main difference between Mom & Son and the Sisters is the added complexity of impact investments. This causes the accounting costs for Mom & Son to be greater. Impact investing also adds an extra burden on their family office. This trade-off is still preferred by Mom & Son. However, they feel like the positive impacts they can make by investing this way. And feel the benefit outweighs the extra cost.

Certain Costs are Worth It (Depending On Your Goals)

Mom & Son paid twice as much for their accounting and family office than the Sisters. But, their after-tax income was only 10% less. So, one could argue that the added benefits of making impact investments are a small price to pay. For them, the difference can be found in the impact those investment may achieve. But, whether that is true for you will depend on your values.

Overall Cost Benchmarking

Comparing the Management Expense Ratio (MER) of each client scenario is also interesting. We know that investment management fees are by far the most important wealth management expense. Investment management fees also vary widely between service providers and investment types, so its especially important to consider these differences when creating an investment policy.

What might surprise some readers is why DIY Guy would pay $60,000 for a family office. Consider his overall MER of 6 bps, and then wonder how much more time DIY Guy might need to spend doing administrative tasks compared to decision making without his family office. When DIY Guy gets a standard quarterly report from his family office, he can rest easy knowing there is a capable backup person for his rental property and stock portfolio. His family office provides DIY Guy with peace of mind.

Markdale Financial Management: Family Office Services

Our family office provides custom services to our clients to help them manage their wealth in a way that supports their values and achieves their financial objectives. Please get in touch with us if you would like us to provide you with recommendations based on your own scenario.