Should You Rebalance Your Portfolio?

Rebalancing is the process of realigning the weightings of a portfolio of assets. Rebalancing involves periodically buying or selling assets in a portfolio to maintain an original or desired level of asset allocation or risk. This post will describe some methods to rebalance your portfolio, and consider alternative ways to think about the concept.

Rebalancing Your Investment Policy

Conventional financial wisdom says that investors should identify their values, goals, risks, and then create an investment policy to guide their decisions. This approach makes intuitive sense because investor psychology proves that “shooting from the hip” without a plan exposes investors to common biases that are a drag on returns.

Further, a structured investment process grounded in a written plan helps financial professionals provide advice. This is true because a financial plan will ground the investment advisor’s recommendations and is used to evaluate their success or failure.

Your investment policy may include an asset allocation and this is where the debate over rebalancing begins.

Does having asset allocation targets in your investment policy necessarily require you to rebalance your portfolio periodically?

What do investment advisors say?

Investment Advisors often promote rebalancing as part of their investment management process. But is rebalancing necessary or does it simply give your advisor another reason to charge you for advice? There are clear benefits to making investment decisions based on a formal investment policy, but does this naturally mean we also need to rebalance portfolios periodically?

The main benefits of rebalancing is that doing so will re-align your portfolio with the risk and asset allocation targets set out in your investment policy. But is this a good thing? Let’s dig deeper.

Does rebalancing an investment portfolio enhance returns or is rebalancing a drag on returns?

Consider the greatest investors. Do they rebalance their portfolio’s periodically?

In fact, the greatest investors of all time do not rebalance their portfolios,. Warren Buffet does not rebalance his portfolio to match a desired asset allocation. Conversely, he doesn’t have an asset allocation at all. Warren Buffet simply invests in stocks for the long run. His strategy (which is very successful) supports the idea that rebalancing a portfolio to align with pre-determined weightings should be avoided, not embraced.

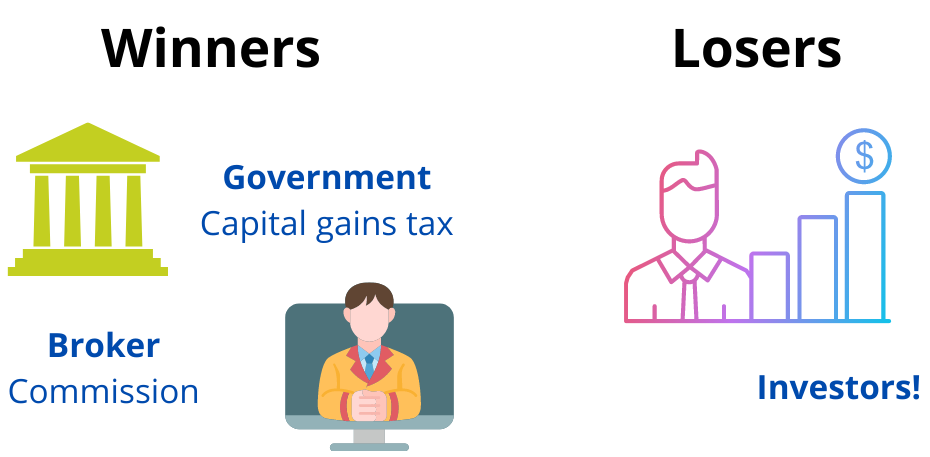

The idea of portfolio rebalancing is supported by financial advisors because it combines the interests of the financial industry and regulators. Regulators want investor portfolios to match their risk tolerance (to cover their ass). Advisors want to provide services to investors. So rebalancing supports both of these objectives. But at the investor’s expense?

Who Wins? Who loses?

- When you rebalance your portfolio, the government wins. This is because when you sell your winners to buy more of your losers, you will trigger capital gains tax (this is rebalancing).

- Your broker or investment advisor also wins when you rebalance. This is because when you buy & sell, either a commission is charged, or you are paying a fee to your investment advisor who offers you rebalancing as a service.

Alternatives to Rebalancing

Let’s say you hold stocks, bonds, and real estate in your portfolio. If stocks outperform bonds in the long run, then if you rebalance, eventually you’ll need to sell stocks and buy more bonds. But what if you don’t? Won’t stocks just keep outperforming bonds in the long run? By selling stocks and buying bonds to rebalance, you will limit your overall returns.

Does risk mitigation outweigh the cost of long term underperformance?

If income is what you want, can’t you simply buy stocks with higher dividends? Especially during this time of low interest rates, there are many more stocks available paying higher income than most bonds, especially considering the tax on dividends is much lower than the tax on interest.

Rebalancing ensures you will never outperform

More diversification will draw performance closer to the average. While more concentration will make your portfolio less correlated to the average.

If investors such as Warren Buffet were to periodically rebalance, they would likely never achieve their goal of outperforming the average because they would be regularly selling their greatest investments and re-allocating those funds to the worst. Rebalancing will draw returns closer to the average.

“But if I don’t rebalance, what do I do?” (Keep investing)

A simple “buy and hold” investment strategy is perfectly sound and easy to implement (maybe that’s why investment advisors don’t promote it). Buy and hold forces you to think hard about the investments you make since you don’t plan on trading in and out. A buy and hold discipline is good for your portfolio because it minimizes taxes and trading costs.

With a buy and hold approach, your investment decisions can still be guided by an investment policy or financial plan with an asset allocation target. The dividends from your holdings and extra savings you might add to your portfolio need to be re-invested anyway, and when you do have extra cash, this is when you should consult your investment policy to help you determine where to invest new money. Maybe you SHOULD buy your underweight asset classes with new cash to mitigate risk.

Successful Investors

Every single successful investor I have ever known has a buy and hold investment philosophy. Whether it be stocks, their business, real estate, etc. They don’t trade, they simply pick the highest quality investments that they believe will perform the best in the long run. Sometimes they use an investment advisor, sometimes they do it themselves. Either way, they aren’t trying to guess the day to day movements of the financial markets. They simply keep their portfolio focused on the long run, reduce costs, and minimize their psychological bias. The greatest investors aren’t any smarter than the average, they simply leverage their personal discipline.

The buy and hold approach to investing reduces costs and taxes, and supports disciplined investing.

Never sell your investments, ever.

Why would you ever need to sell a good investment?

Common responses are:

“I believe the business climate will get worse in the short term and the stock market will fall”

This response comes from someone who believes they can accurately predict the future. But empirical evidence shows that the greatest investors are the ones who stay invested during all business cycles and when times get tough, they double down to invest even more. Investors who think they can time the market should do more research or work with an investment advisor to learn about investing biases such as “overconfidence bias”.

Another response towards selling investments is:

“I want to sell stocks to raise cash to consume (i.e. I want to buy stuff)”

This response comes from people who value consumption more than growing their capital. Ask yourself: does consuming your capital make for a better life?

Lastly, another excuse to sell your investments includes:

“I want to rebalance my portfolio”

Rebalancing costs time and money. Whether you do it yourself, use a robo-advisor, mutual fund, or a full-service investment advisor, you must pay fees and transaction costs to rebalance.

Rebalancing has tax consequences. Selling your winners means you will incur capital gains and associated tax. So buy and hold, and never sell your good investments. This means you avoid triggering capital gains tax too (what a great side benefit :).

By not rebalancing, you have a chance to outperform the average by letting your greatest investments rise to infinity. Whereas rebalancing cuts your portfolio off at its knees.

Rather than rebalancing your portfolio based on your target asset allocation, ask yourself a different question, like “what are suitable long-term investments for me based on my values and goals?” Explicitly list these in your Investment Policy.

Its hard to tune out the drum beat of the financial services industry claiming they help you by rebalancing your portfolio. But to be a successful investor, you must cut out the noise and focus on the facts.

Avoid rebalancing your portfolio, and never sell your best investments.