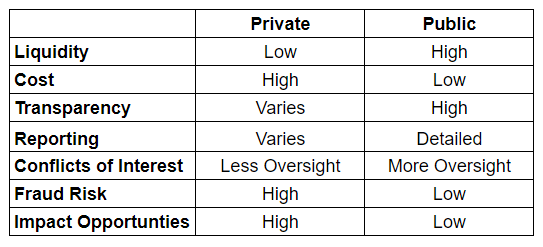

Public vs Private Investments

Should you invest in private companies or public stocks? Since there are many differences between public and private investments this post will discuss their unique features and how those attributes are used by different types of investors.

Over the past several decades, investors have been shifting their focus from public company investments to private investments on a broad scale. While new retail investors might join apps like Robinhood or Wealthsimple where public stocks are offered, pension funds and endowments have turned away from public markets towards private ones. Meanwhile, there has been a dramatic shift towards low cost index funds from retail investors especially, which invest in public markets. These index funds have been embraced by retail investors because they are cheap and easy to manage. Ironically, the boom in so called “passive” investing has also spawned a renewed interest in private market “active” strategies.

Liquidity

Public investments are more liquid compared to private ones. This means that investors who want the cash value of their investment can get it quickly using stock exchanges, but the same isn’t true of private markets. Many private investment funds have “lock-up” periods where investors can only receive the value of their investment in cash during specific times and situations.

Short Term vs Long Term?

Private market proponents often claim they can take advantage of a long-term approach to ride out or avoid short term volatility by not being required to value investments on a day to day basis, while private market salespeople may also also say that the public markets are too focused on short term results. This argument advanced by private market proponents is impossible to verify since the returns of private investments are much more difficult to evaluate unlike the standard methods of public markets

Cost Matters

The cost of private investments is generally higher than public investments. The glare of public markets forces managers to cut costs to compete, and any difference in fees between public market managers is rooted out by market forces. While the cost for private investments tends to be much higher since its tougher for investors to evaluate fees inside of opaque structures. Those selling private market investments also claim that their higher fees make sense because they often promise higher returns (or at least the prospect of higher returns).

Transparency

The transparency of public markets is high. Public companies disclose lots of information to investors in standardized ways. This makes it easier for investors to evaluate public companies against each other. But the level of transparency with many private market investments is low. Many private companies and private equity funds claim that their lack of transparency is related to their proprietary business process which they cannot fully disclose because it would make their competitive advantage vulnerable.

Disclosure

Reporting requirements for public companies is onerous and standardized. Whereas the reports investors might receive from their private investments are varied and unique to the investment. There are much fewer reporting requirements for private company investments compared to public ones.

Conflicts of Interest

Although there are still inherent conflicts of interest with public companies, the glare of public markets and the regulatory environment prevent the most egregious ones. With private markets, there are far fewer checks and balances.

Risk of Fraud

Compared to private investments, the risk of fraud in public markets is low. Although cases like WorldCom still happen occasionally, they are rare compared to fraud in private markets where there is a lot less oversight and market discipline.

What about ESG?

If you’re looking to make a positive social and environmental impact with your investments, the public markets offer a lot less opportunity. With private market investments, investors can choose from a wide and growing menu of investments that have more than just profits in mind. Private market investors can better tailor their investments to meet their ESG requirements.

Which is Best?

Considering that private markets are less liquid, more expensive, less transparent, are have a greater risk of fraud and conflicts of interest, why are certain types of investors shifting their focus to them and away from public market investments? Pension funds and institutional endowments are turning towards private market investments and away from public market investments. This seems curious considering the wide range of benefits that public markets offer.

Beware of Salespeople

Let’s keep in mind that the fees for private market investments such as private equity funds are much higher compared to low cost index funds. This means that private equity funds will employ salespeople who are at least partially compensated by commission. Salespeople will often tell you that their fees are higher because they’re offering the expectation of a higher rate of return. However, this claim cannot be verified before the investment is made, and you’ll only find out if returns are greater after the salesperson has received their commission.

Pension Employee Conflicts of Interest

If you’re employed by a pension fund or institutional endowment, you’ll need to justify your existence. Why would a pension fund need the expertise of “investment professionals” when they can simply buy index funds that guarantee a market rate of return? The conflict of interest between the employees of a pension fund and the pension fund’s members is real. Many pension fund members do not take the time to evaluate the managers employed by their own pension fund. This makes sense since if you’re a teacher, a nurse, or municipal employee, you can’t be expected to be an expert in financial markets as well.

Because of poor planning and unrealistic expectations about investment returns, many pension funds are woefully underfunded. Private investments offer a tantalizing hope to investment professionals employed by pension funds. The promise of greater returns from private market investments could ease the burden of underfunded plans.

Public vs Private

Deciding whether to add private market investments to your portfolio, whether in the form of investment funds or direct investments in private companies depends on your investment goals. If ESG is very important to your portfolio, private markets offer ways that you can support very specific causes. But if cost, liquidity and transparency are important, you should stick with low cost index funds to fund your retirement.

Investment Policy

Before choosing which investments to make, create an investment policy. Click this link to read a post about defining your investment values with a family mission statement.