3 Common Investing Biases and How to Overcome Them

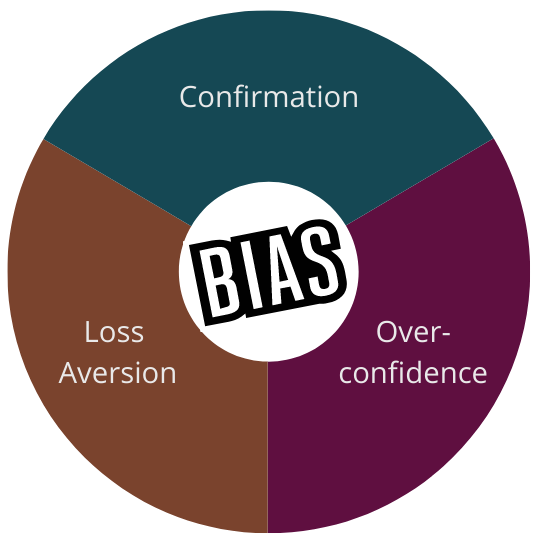

This post describes three common investing biases and how to overcome them. Overconfidence Bias, Loss Aversion Bias, and Confirmation Bias are each discussed. Overcoming these common investing biases will greatly improve your portfolio’s performance and help you gain more consistent returns that meet your objectives.

Overconfidence Bias

Overconfidence bias is when our subjective confidence in our own judgments is reliably greater than the objective accuracy of those judgments, especially when confidence is relatively high.

We commonly overestimate our own abilities. We think our intuition and experience will naturally make us successful investors when the opposite is true.

Overconfidence makes us prone to common investing mistakes and tends to make us less than appropriately cautious in our investment decisions. This stems from an illusion of knowledge and control.

Being mistakenly overconfident in our investment decisions interferes with our ability to practice good risk management. The overconfidence bias leads us to view our investment decisions as less risky than they are and tends to encourage us to take on more risk than is warranted.

Have you ever read an article in a magazine or website about a company and then purchased this stock in your portfolio without doing much further research?

Loss Aversion Bias

The loss aversion bias is our tendency to prefer avoiding losses to acquiring equivalent gains. Notably, loss aversion gets stronger as the stakes grow larger.

Its obvious that we don’t want to incur losses. But the fear of incurring losses can prevent us from realizing losses from unprofitable investments and even contributes to when we double down on losing trades.

Loss aversion bias shows up in our investing lives is when we “chase losses”. This happens when we make an unprofitable investment and then double down with the hope of a rebound. What often happens is we compound our losses and throw “good money after bad”.

Some investors even take this a step further by selling their profitable investments to feed their losing ones. Like a gambler chasing their losses, many investors are gripped by the same psychology.

Have you ever continued to feed an unprofitable investment with new money instead of simply cutting your losses early?

Confirmation Bias

The confirmation bias describes our underlying tendency to notice, focus on, and give greater credence to evidence that fits with our existing beliefs.

Confirmation bias is dangerous for investors because it causes them to have a distorted view of reality and only pay attention to news and information that confirms with their own opinion.

My friend gave me a hot stock tip of a small company that was developing a new medical device which he had invested in. This company did not make much revenue and no profits. When I highlighted how unprofitable the company is as a reason not to invest, instead of acknowledging this reality, my friend painted a rosy picture about the company’s future prospects.

How to Overcome Common Investing Biases

Overcoming common investing biases will greatly increase the consistency of your investment returns, enable you to meet your investment objectives, and ultimately give you much more financial peace of mind. To do so requires sticking to investing fundamentals like having a plan and following it. Most investors do not have a financial plan or an outline of their investment policy and this contributes to why the average investor underperforms investing indexes.

Having a plan, even a 1-page basic outline is better than no plan at all.

The main benefit of having a written investing plan is it puts some limits around our “gut feelings” and prevents us “shooting from the hip”, thereby helping us to avoid common investing biases.

There are basically two approaches to decision-making:

- Reflexive – Going with your gut, which is effortless, automatic and, in fact, is our default option.

- Reflective – Logical and methodical, but requires effort to engage in, actively.

Successful investors are reflective, disciplined, and methodical. Successful investors consistently follow an investing process and philosophy. They pay attention to achieving their financial goals as outlined in their financial plan.

The first step to achieving consistent results for your investment portfolio and giving you financial peace of mind is to create a financial plan tailored to your unique values and objectives.

An advisor can help you become a successful investor when they support the development of your unique wealth management process that includes a definition of your values and goals, and a clear financial plan that is used to evaluate your success. Our family office supports our client’s investing success by helping them craft a personalized wealth management process that reflects their unique values and goals.