Estate Freeze Basics

An estate freeze caps the current capital gains tax liability of an asset expected to appreciate and transfers the growth in value to successors. Families use estate freezes to pass down assets to future generations such as kids and grandkids. Businesses also use estate freezes to transition ownership to family members and/or employees.

Why freeze an estate?

Canadian taxpayers are deemed to dispose of all their property at fair market value when they die. This means capital gains taxes are triggered when someone dies. One way to delay this payment is to arrange an Estate Freeze.

What is an estate freeze?

An estate freeze transfers the future increase in the value of certain assets to successors (such as children & grandchildren). Commonly, the goal of an estate freeze is to delay paying capital gains taxes by transferring the future tax liability to a younger generation.

Freezing the value of an asset for the current owner makes sense in a variety of situations such as passing on a business (to family or employees), real estate (such as an apartment building or a cottage) and holding companies with marketable securities.

How it works

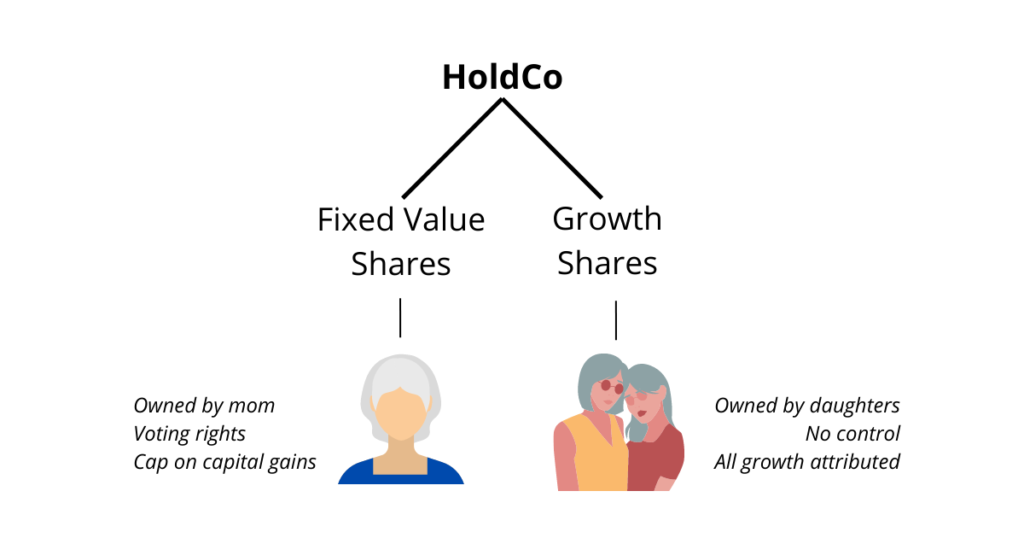

An estate freeze works by having an asset owned by a corporation (a “holdco”) where two classes of shares are created. One class of shares has a fixed value, the other class has no fixed value (typically called “growth shares”).

The owner of the fixed value shares will be the person wanting to freeze the value of their future tax liability. The owners of the growth shares are those who will take the future growth. The share classes can also have various voting rights to divide control of the holdco.

How it’s done

Consider a family with a holdco owned by mom who is 55. Two daughters are in their 20s. Their holdco (inherited by mom after the sale her grandfather’s business) owns $10 million of blue-chip stocks with an ACB of $5 million. The goal is to freeze the value of mom’s future capital gains tax liability while leaving her in control.

Ownership of the holdco will be arranged so a share class with a fixed value and all voting control will be held by mom. A second share class will be sold for a nominal amount to her two daughters. These shares will have no control of the corporation but will receive all the growth in the value of it.

The result of this arrangement is to freeze the value of mom’s shares to cap the amount of capital gains tax she will owe on her death. Her daughters will now receive all the future growth in the value of the holdco. This means since mom is expected to die before her daughters, the payment of capital gains tax on future growth will be delayed until the daughters reach the end of their own lives.

Who can help?

When you’re considering an estate freeze strategy, you should seek the advice of your team of professional advisors. Your accountant can give you tax advice, your lawyer can document the corporate re-organization, and your family office can co-ordinate meetings, take notes, create illustrations, and be your sounding board.

Read more about a Wasting Freeze here.