Buy-and-Hold Investing: Lessons from Egg and Chicken Farmers

In the serene landscapes of rural life, two distinct types of farmers thrive – the chicken farmer and the egg farmer. While both operate farms, they adopt vastly different strategies. Mirroring the diverse approaches in the world of portfolio investing. This post explores these strategies and draws parallels with the investment philosophy of Warren Buffett, while describing why a time-tested buy-and-hold investment philosophy provides the greatest peace of mind to long-term investors.

Before we begin, let’s put your financial knowledge to the test. Try out our free financial literacy quiz and see how you stack up!

What is the Buy-and-Hold Investment Strategy?

The buy-and-hold investment strategy involves purchasing assets and holding them for an extended period, regardless of market fluctuations. This approach contrasts with more active trading methods, where investors frequently buy and sell based on short-term market trends. Advocates of buy-and-hold believe it minimizes transaction costs, reduces tax implications, and helps avoid the emotional pitfalls of market volatility. By focusing on long-term growth and the compounding of returns, investors can benefit from the steady appreciation of their assets over time, much like the egg farmer who relies on consistent egg production rather than market prices.

The Chicken Farmer: Chasing Market Value

Imagine a farmer who raises chickens. Their livelihood depends on the fluctuating market prices of chickens. They buy chicks, nurture them, and their profit hinges on selling these chickens at higher prices. This is a world of unpredictability and risk, echoing the investment style focused on asset value appreciation.

The chicken farmer’s approach is much like the investor who buys stocks or real estate with the aim to sell them at higher prices in the future. These investors are often at the mercy of market trends, finding themselves constantly analyzing market fluctuations and economic forecasts. They experience highs and lows, akin to their joy at high chicken prices and despair during market downturns.

The Egg Farmer’s Steady Income: A Model for Investing

In contrast, meet the egg farmer. Their focus is not on the price of hens but on the consistent production of eggs. The egg farmer benefits from the ongoing income their eggs provide, regardless of the market value of their hens. This steady, predictable income stream defines the egg farmer’s success.

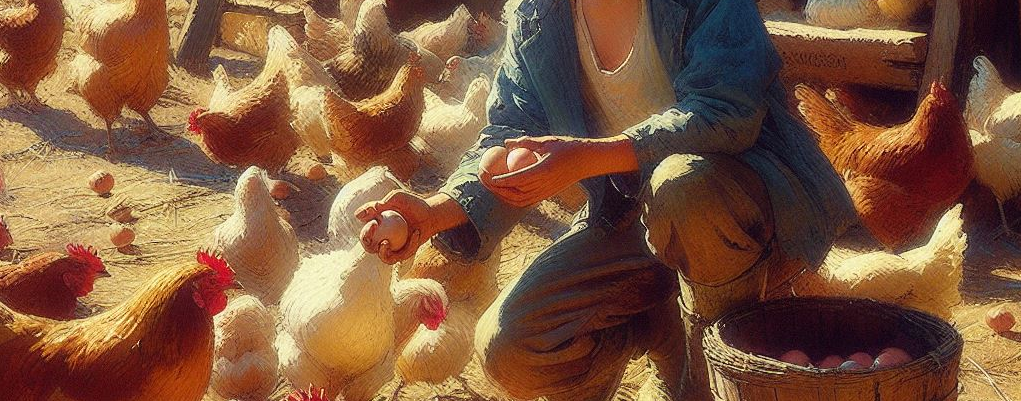

The egg farmer’s approach mirrors that of the income-focused investor. These investors look for assets that provide regular returns, like dividends or rental income. They are less concerned with short-term market fluctuations and more with the long-term, consistent performance of their investments and compounding returns. This style embodies a calmer, more stable approach to investing. Much like the egg farmer’s peaceful mornings collecting their harvest.

Warren Buffett: The Quintessential Egg Farmer of Investing

Warren Buffett, often hailed as one of the greatest investors ever, embodies the principles of the egg farmer. Buffett focuses on the intrinsic value of companies, seeking businesses that offer steady, long-term growth and reliable income. His investment in companies like Coca-Cola and GEICO highlights his preference for entities with strong fundamentals and consistent earnings.

Buffett’s philosophy is akin to buying a fertile hen that lays eggs year after year. He shuns the idea of frequent buying and selling, preferring instead to hold onto his investments forever. This long-term, stable approach has not only minimized his risks but also maximized his returns, much like the successful egg farmer’s ever-growing flock of productive hens.

The Power of Long-Term, Buy-and-Hold Investing

A long-term, buy-and-hold approach, much like the egg farmer’s strategy, offers several financial advantages:

- Reduced Fees: Frequent trading incurs higher transaction costs. By holding investments over the long term, investors can significantly reduce their costs (in both time and money).

- Lower Capital Gains Taxes: By minimizing buying and selling, long-term buy-and-hold investors can also minimize the negative impact of incurring capital gains taxes.

- Mitigation of Psychological Bias: The long-term buy-and-hold approach shields investors from the emotional rollercoaster of market highs and lows, reducing the likelihood of making impulsive, poorly-timed investment decisions by getting caught up in current market sentiment.

Before you begin investing, make sure you have developed a strategy! Try out our free investment policy generator for a more personalized investing strategy!

Our Family Office: Embracing the Egg Farmer’s Philosophy

At our family office, we adopt a philosophy akin to the egg farmer. Our approach is guided by formal investment policies that emphasize long-term, buy-and-hold strategies. We believe in the power of compounding returns and the peace of mind that comes with not chasing the latest market trends. Our clients invest their earnings back into their portfolios, steadily growing their wealth over time.

This approach ensures that we are not swayed by the volatility of the market. Instead, we enjoy a sense of financial stability and peace, knowing that our investments are growing steadily, much like the dependable production of eggs.

We invite you to contact us, or schedule a complimentary review of your situation, to explore how we can assist you in navigating the investment landscape with confidence and clarity.

A Story of Stability and Growth

The perspectives of the chicken farmer and the egg farmer provide a vivid illustration of different investment styles. While the chicken farmer’s approach is akin to chasing market value, the egg farmer focuses on steady income. Warren Buffett’s successful investment strategy aligns closely with the egg farmer’s philosophy. And at our family office, we embrace this approach, offering our clients a path to financial stability and growth, free from the distractions of market trends and short-lived fads. In the end, it’s about nurturing investments that yield consistent returns, ensuring a prosperous financial future for our clients, much like the bountiful harvest of an egg farmer.

Don’t forget to subscribe to our free newsletter for valuable insights delivered monthly.

Leave a Reply