Category: Foundations

-

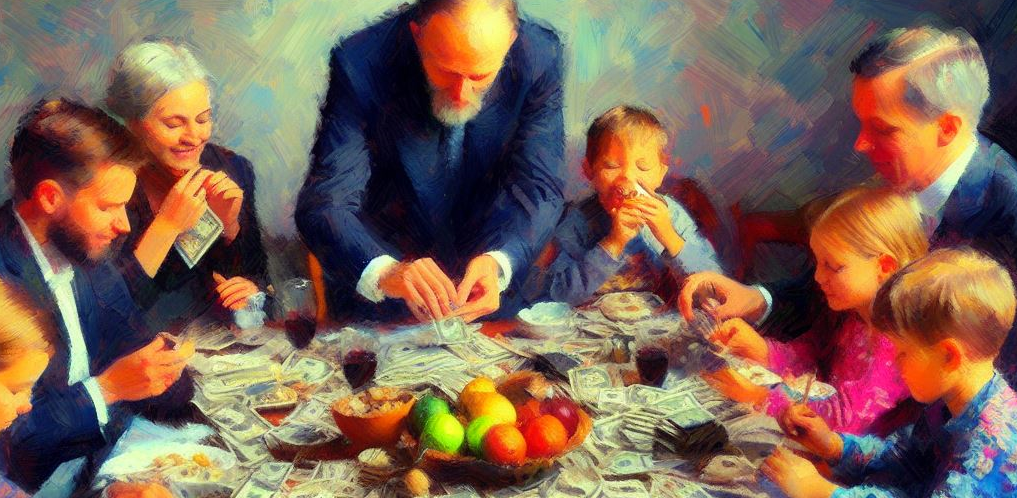

Values Based Wealth Management

Managing and transferring wealth across generations is a formidable challenge. And often, the most important element is the perspective of the family members, rather than any specific investment strategy. So, at our family office, we understand this journey is about more than just numbers and assets. It’s deeply rooted in values based wealth management that…

-

Wealthy Inheritors: The Quest for Purpose Amidst Plenty

As many wealthy inheritors will attest, the “freedom” that comes from material abundance can lead to a paralyzing myriad of choices. Rather than liberating, wealth can often make the journey towards finding a meaningful contribution – a vital part of a rewarding life – surprisingly complex. So to help demystify this journey, this post describes…

-

Passive Investing: Embracing the 80/20 Rule

As the thrill of quick gains often grabs headlines, passive investing emerges as the silent giant, embodying the virtue of patience in a race paced by speculation. It’s the strategy that champions the adage “slow and steady wins the race,” turning a deaf ear to the siren calls of market timing and rapid trading. Surprisingly,…

-

Family Meetings for Wealth Management Success

Within wealth management, family meetings have emerged as a valuable tool for generational wealth transfer. Through our family office, we’ve seen a growing number of clients harness the power of family meetings to prepare their next generation for the responsibilities and opportunities that lie ahead. Here’s how and why these gatherings are transforming the wealth…

-

Catalytic Capital: Impactful Investments for Change

Family office investors are taking an increasingly significant role advancing environmental, social, and governance (ESG) objectives through their investments. One key strategy gaining prominence in this space is the use of “catalytic capital.” Catalytic capital is a dynamic financial tool that combines private capital, pooled investment funds, and charitable capital to drive positive social and…

-

What is Consolidated Reporting?

Consolidated reporting refers to the process of aggregating and presenting various investments in a unified and comprehensive way. The goal of consolidated reporting is to provide stakeholders with a clear and holistic view of an entire investment portfolio, regardless of where those assets are held or what type of investments they represent. Imagine you’re an…

-

Six Ways to Amplify Your Foundation’s Impact

To improve impact, it’s crucial that all charitable foundations continuously refine their approaches to increase their efficiency. Here, are six strategies to help your foundation amplify its impact: 1. Measure: Choose Metrics and Collect Data Just as businesses gauge their success through Key Performance Indicators (KPIs), charitable foundations should select relevant metrics that capture their…

-

Unlocking Liquidity: The Role of NAV Loans in Private Equity

One of the main problems with private equity (“PE”) is the lack of liquidity. To get around this, companies often use so-called NAV loans. With the downturn in the mergers and acquisitions market during 2023, many PE investors are finding themselves in a tight spot, contemplating an expensive solution: borrowing against their stakes using net-asset-value…

-

Private Equity Financing: Rising Trend of High-Cost Loans

Private equity financing (“PE”) has always been about navigating the complexities of financial structures, seeking out lucrative deals, and balancing risks and rewards. But recently, PE firms are financing their deals and commitments in curious new ways. And with these shifts come new risks and opportunities for investors. Before we begin, let’s put your financial…