Active vs Passive Investing

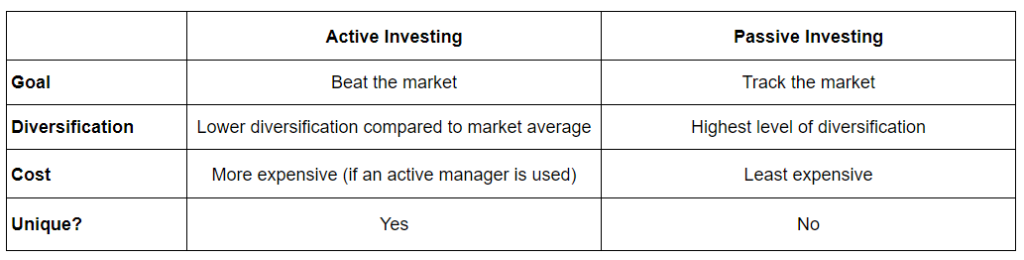

Active investors attempt to outperform the returns of a benchmark by applying an investing strategy. Passive investors simply mirror the returns of a benchmark by using low cost index funds. This post will briefly compare active vs passive investing approaches.

Active investing aims to beat the market whereas passive investing aims to track the market. Passive investing was made possible by index funds that tracked a market average. The most popular index funds are offered by Vanguard and iShares and were popularized in part by books like A Random Walk Down Wall Street.

Active vs Passive Investing

The potential returns of investing actively are unlimited. While investing passively in low cost index funds ensures you will always generate an average market return. While it is possible to outperform the market using active investing strategies it is unlikely.

For the average investor, using low cost index funds is an easy way to save for retirement. A passive investing strategy will ensure you keep pace with the average market return each year. If you hold a portfolio of index funds gaining you exposure to different asset classes such as stocks, bonds, and real estate, then even better.

What about ESG?

Besides the potential to outperform the market average, what else do investors give up by using index funds? Passive investors often cannot have a portfolio that reflects their values using a passive strategy using broad stock averages such as the S&P500. This is because the S&P500 contains companies that many ESG oriented investors would not support such as Exxon Mobil and other oil & gas companies. The S&P500 also contains companies who make weapons and provide gambling products.

ESG Index Funds

Thankfully, ESG investors now have a lot of lower cost ESG index funds to choose from. The challenge at the time of writing is the difficulty for the average ESG oriented investor to find the right ESG index funds that match their investment goals. Those investors will probably need an investment advisor to recommend ESG index funds and to re-balance their portfolio as new funds emerge. A “passive” ESG strategy might not ever actually exist as our values change over time and this requires us to actively pursue those strategies that reflect our new values, even when using index funds.

Investing Wisdom

Some aspects of investing are always a sure thing. Always keep costs as low as possible and stop trading as the potential to beat the market is slim. Avoid chasing hot managers as you’ll likely fall prey to a slick sales pitch instead. And ensure that your portfolio reflects your personal values so that you stay true to yourself no matter how your portfolio performs economically.

Family Office Advantage

Our family office services help ultra high net worth ESG investors identify their values, create an investment policy, and work with an investment advisor to craft a portfolio that reflects their goals. Click on this link to read more about how we help our clients.