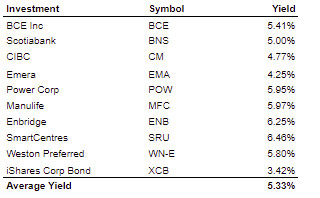

A High Yield Portfolio

Many wealthy and retired investors have their primary investment objective as income generation. So, this post identifies 10 Canadian blue-chip investments with high yields that might be suitable for your portfolio.

The holdings listed below are “blue-chip” since most are members of the S&P/TSX 60 Index and all are established companies with long track records. The companies in the list below also have long histories paying their dividends and most have consistently raised their dividends over many years too.

The first seven companies in this high yield list are individual companies that are members of the S&P/TSX 60 Index. With an average yield of just over 5%, the stocks on this list have distribution yields that are twice the current rate of the S&P/TSX 60 Index.

At the time of writing, the largest company in Canada is RBC with a market cap of $185 billion and the smallest company in the S&P/TSX 60 Index is SNC Lavalin with a market cap of under $5 billion. The list of high yield stocks presented above features mostly larger companies. For example, Enbridge is currently the 3rd largest company in Canada, CIBC is 14th, BCE is 15th, and Manulife is the 17th largest with market caps in the $60 billion range. Power Corp has a market cap of $22 billion and Emera is worth $16 billion.

While the seven stocks described below are some of the largest Canadian companies, the other three investments could be substituted for several alternatives. For example, SmartCentres has a market cap of $4.5 billion which makes it larger than the smallest company in the S&P/TSX 60 Index. Any fixed rate preferred share from a S&P/TSX 60 Index listed company could be substituted for the preferred share from George Weston Ltd. And, if an investor is queasy about bonds, they could easily find other high(er) yielding ETFs.

Below I will describe each holding on this high yield list, so investors can get a sense of the risks & rewards these stocks present.

BCE Inc

Better known as Bell Canada, BCE is a Canadian telecommunications company with a nationwide fixed line and mobile network. Bell offers customers legacy telephone services, mobile phone services, internet, and media. The company has almost 10 million mobile phone customers, 4 million internet customers, and 3 million TV customers.

Bell Canada has two major competitors and a handful of secondary competitors in specific markets. Telus and Rogers are the main competitors to Bell Canada. The biggest areas of growth for Bell Canada is mobile revenue, while Bell Canada expects to continue losing fixed line telephone customers. BCE does not have a controlling shareholder, although the federal government has a large influence on how it operates.

Bank of Nova Scotia

Scotiabank is one of the largest banks in Canada but also has large operations outside Canada including Mexico, Chile, and Peru. 44% of Scotiabank’s earnings comes from Canadian banking, 20% from international banking, 15% from wealth management, 21% from capital markets investment banking.

Investors have given Scotiabank stock a lower valuation because they are concerned about political risk in the key countries within their international banking segment, specifically Chile, Peru, and Columbia. The wealth management segment also garners a lower valuation because investors expect further fee compression in fund management.

Canadian Imperial Bank of Commerce

CIBC is the smallest of the five largest Canadian banks. Over the past decade, it has also had the highest dividend yield. Until recently, CIBC was the most domestically focused of the major banks too. This changed when CIBC purchased PrivateBancorp in 2017, which gave CIBC more exposure to US banking markets.

Scale is a challenge for CIBC compared to its close competitors. For example, Scotiabank has a market cap almost 1/3 larger, and RBC is 3 times larger than CIBC. Scale will become increasingly important because technology spending in the financial services industry will likely accelerate in the coming decades. However, CIBC has a profitable domestic banking operation and draws steady profits from this business.

Emera

Created in 1998 from the privatization of Nova Scotia Power, Emera is an energy utility holding company. Emera derives revenue from Nova Scotia Power, Tampa Electric / People’s Gas, and other gas & electric utilities which include the electric utilities in a few smaller Caribbean markets including Bahamas, Barbados, Dominica, St Lucia, and also New Mexico. 48% of Emera’s earnings now come from their Tampa Electric subsidiary.

As the sustainable energy transition continues, Emera plans to reduce electricity generation from coal and move further into natural gas, wind and solar generation. Emera currently generates 20% of their electricity from coal but aims to reduce this to 10% by 2025. Another major development for Emera is the completion of the undersea electrical pipeline linking energy generated at Muskrat Falls in Newfoundland & Labrador to Nova Scotia.

Power Corporation of Canada

Power Corp is the holding company for financial services companies controlled by the Desmarais family. The company controls Great-West Life which includes Canada Life and Irish Life. Power also controls IGM Financial which operates IG Wealth Management and Mackenzie Investments. It also controls a grab bag of other financial services and portfolio investments including a 14% interest in Groupe Brussel Lambert, a controlling stake in Wealthsimple, and Power Sustainable Capital.

Power Corporation offers Canadian dividend investors a steady stream of income driven mostly by distributions from Great-West Life and IGM. The downside is Power is exposed to changes in technology that put pressure on insurance and wealth management revenue. This is one of the reasons why the company has been making more investments in emerging fintech.

Manulife Financial

Manulife is a globally diversified financial services company that offers insurance and investing services in Canada, Asia, and under the John Hancock brand in the United States. Asia represents Manulife’s largest business segment as the company operates in 11 Asian countries. In both Canada and the United States, Manulife distributes their services through a captive sales force and independent brokers. But in Asia, Manulife has a captive sales force in some countries, and partners with local bank distributors in bancassurance deals.

The biggest challenge to Manulife, like other financial services companies on this list is continued fee compression in fund management. Manulife will need to deepen the use of technology and broaden the suite of services and fund types it offers to combat this risk. Fighting fee compression will mean investing in new technology to change the way their products are both created and distributed.

Enbridge

Enbridge is a natural gas transmission company that operates pipelines for both downstream and upstream customers. Enbridge operates long haul pipelines from western Canada to eastern Canada and to the BC coast and into the United States. The company also delivers natural gas to homes in Ontario.

In many ways, Enbridge has been helped by the political opposition to pipelines in North America. This has made it hard for pipeline companies to build new lines and therefore restricted the supply of pipelines, thereby making existing pipelines more valuable. An opportunity for Enbridge exists to develop new renewable sources of energy in the form of wind and solar, and the main challenge for the company will continue to be opposition to the environmental impacts of using natural gas as an energy source.

Fixed Income

Three of the investments on this list SmartCentres, Weston Preferred Shares, and the iShares Corporate Bond ETF could be substituted for any other similar investments. In the current interest rate environment, Real Estate Investment Trusts (REITs) still provide some of the highest distribution rates. Unfortunately, they are also taxed at the highest rates too. This means REITs are better investments inside of registered accounts (RSP, TFSA, RESP, RIF) and charitable foundations. SmartCentres owns many Walmart anchored plazas across Canada. Many of these sites could be re-developed to provide for greater density. This strategy is also being used by other REITs such as RioCan and Choice Properties.

Fixed rate preferred shares offer dividend income which is taxed advantaged but are the most sensitive to interest rates. When interest rates fall, the value of fixed rate preferred shares will rise, but when rates rise, these preferred shares will fall in value. In falling rate environments, fixed rate preferred shares will likely have returns capped as most can be called by the issuers at pre-determined levels. Investors can survey the yields on Canadian preferred shares by using online resources like the one linked here.

Concluding Thoughts

Building a portfolio that satisfies your income requirements is important for many wealthy and retired investors. But many of these investors also want to grow their capital to keep up with inflation. Therefore, investing in high dividend stocks is important. Depending on the company, they may be able to raise their prices and grow earnings during times of rising prices. In turn, these stocks might also be able to raise their dividends.

Investors should pay close attention to balancing the need for income and growth. How you might tilt your investment portfolio towards income or growth will depend on your objectives which are informed by your age and stage of life, but also your income requirements.

Oftentimes, wealthy investors hold diversified investments that provide them with enough income to satisfy their personal spending, but also allows them to fund charitable donations. These investors will likely have dividends that provide for their income, but also public stocks tilted more towards growth that may be donated on a tax efficient basis.

Building an investment portfolio that meets your objectives begins with drafting an investment policy that details your strategy, consulting with your investment advisors to choose suitable investments that match your objectives and then consulting with your accountant and tax advisors to ensure you have structured your portfolio in the most tax efficient way. Our family office helps our clients identify their values and goals and then we draft investment policies that can be used to guide your investment decisions, inform your advisors, and evaluate your progress.