Ethereum Merge

The Ethereum Merge is upon us! Soon, the Ethereum blockchain will undergo a major change to the way it operates. Virtually eliminating its carbon footprint, decreasing fees, and increasing transaction capacity. But, what should users really expect? And, is this a good time to invest in the Ethereum ecosystem?

The Merge changes the way Ethereum is “mined”

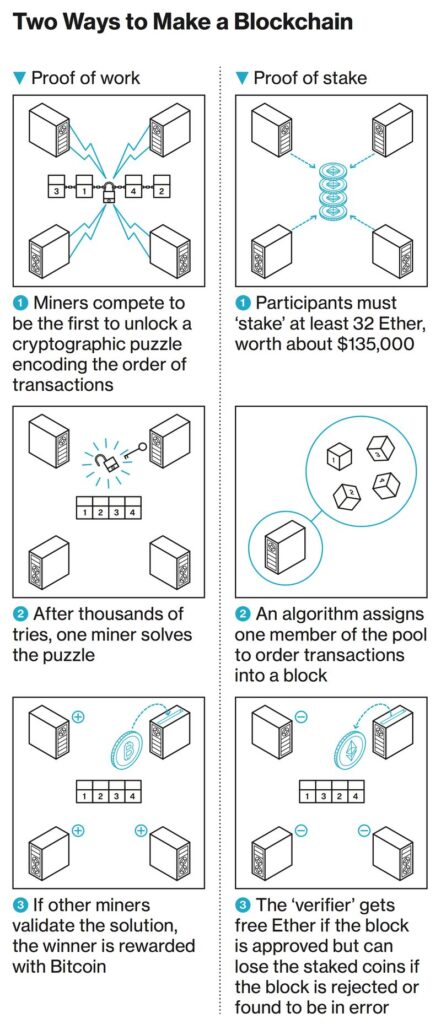

To function without a central authority, blockchains use decentralized methods of transaction validation that incentivize participants to achieve consensus – to confirm transactions are real. For example, the bitcoin blockchain awards new bitcoins to “miners” who deliver mathematical proof. This validation method is called “proof of work”.

Up until 2022, bitcoin and Ethereum have both used proof of work mining methods to validate transactions. But, as the value of bitcoins has risen, and the volume of transactions on the Ethereum blockchain has grown, each blockchain began using large amounts of computing power to operate.

Bad for the environment?

Many see this arbitrary use of computing power (to validate transactions) as wasteful. Some also argue that blockchains could be more scalable if other validation methods are used.

In response, new blockchains have been developed that overcome some of the perceived drawbacks of bitcoin and Ethereum. But, the two largest blockchains are still the largest (in money value by capitalization and transaction volume) and most widely used.

When will the Merge happen?

Around September 15th 2022, the Ethereum blockchain will release a major “upgrade” to the way transactions are validated by changing from a “proof of work” blockchain to a “proof of stake” blockchain. This change is referred to as the Ethereum “merge”.

If successful, the merge will dramatically reduce the computing power required to validate transactions on the Ethereum blockchain. This will in turn reduce the energy used by the blockchain and may greatly increase the blockchain’s ability to validate a much larger number of transactions.

Is this Bullish for the Ethereum economy?

Such a change to the way Ethereum blockchain operates could also usher in a new era of innovation. Applications that require greater processing speed and transaction volume will be easier to run.

Consider Decentralized Exchanges (DEXs) like Uniswap. Currently, trades costs a few US dollars worth of Ethereum to validate. But, if such a transaction could be done faster and for pennies instead of dollars, it could encourage more liquidity on Ethereum based DEXs.

Alternatively, blockchain games using NFTs. When it becomes cheaper and quicker to validate transactions, such games could introduce new features unimaginable using Ethereum’s previous scale & cost.

Scale matters

The Ethereum blockchain already has one of the largest communities of application developers. Plus, the market cap of Ethereum is only second to bitcoin, and the volume of Ethereum transactions is one of the largest of any blockchain. With the shift to “proof of stake”, Ethereum could gain more network effects and achieve much greater scale.

What can users expect?

Some expect the power used by the Ethereum blockchain to decrease by 99%. If this comes to be, it will remove a major environmental criticism by reducing the energy footprint of Ethereum dramatically.

The price to make a transaction on the Ethereum blockchain may also decrease. But supply and demand will determine by how much.

Is this a good time to buy?

Upgrades to Ethereum is bullish for investors. Until now, one of the main criticisms of bitcoin & Ethereum is their large energy footprints. But, following the merge, Ethereum will use much less energy to operate.

Another challenge for Ethereum was its inability to scale to a level of networks like Visa, Mastercard, and other centralized payment systems. But, following the merge, Ethereum will be able to process more transactions per second than many proprietary payment networks.

What about the risk of centralization?

When Ethereum moves to a “proof of stake” validation method following the merge, there is a greater chance that validation becomes more centralized. Capital that’s poured into staking by funds and other well capitalized investors could centralize the system and pose a risk to the blockchain itself. But with a market cap near $200 billion at the time of writing, the risk is still low that one group could control enough tokens to determine transaction validation independently.

What’s next?

Many expect the Ethereum merge to occur around September 15, 2022. When it happens, there may be some strange side effects. Miners who own equipment previous used in proof of work validation may shift their focus to other blockchains where these methods still apply. This will include Ethereum Classic and other proof of work blockchains. Another strange effect is that a side chain or multiple side chains of the current Ethereum blockchain will continue to exist. There are plans by many miners to continue on a EthereumPOW side chain following the merge.

What should investors do?

Most investors should avoid cryptocurrencies. Investing in such new technology will not help most investors reach their financial goals. But, investors should also pay attention to technological trends. Fundamental changes to our economy from innovation will impact the way our capital markets function and the choices we have. Our family office can help you put your financial life into context. We help our clients understand their goals and guide them towards decisions that help achieve them.