Disbursement Quota for Canadian Charities

Following political pressure for Canadian charities to spend more of their capital, the federal government announced in their 2022 budget that the Disbursement Quota (“DQ”) for registered charities will be raised to 5%.

This post describes the latest changes to the disbursement quota and how they may affect your private foundation.

What is the Disbursement Quota (“DQ”)?

The DQ is the minimum amount that a registered charity must spend in a year to furthering its charitable mission or making grants to qualified donees. For private foundations, this means giving at least 5% of their capital to qualified donees each year. Qualified donees are other registered charities.

Currently, the DQ rate is equal to 3.5% of a registered charity’s property not used directly in charitable activities or administration. The DQ is intended to ensure that registered charities deploy their tax-assisted investment assets for charitable purposes. At the same time, allowing charities to continue to grow those assets at reasonable rates to support future charitable activities.

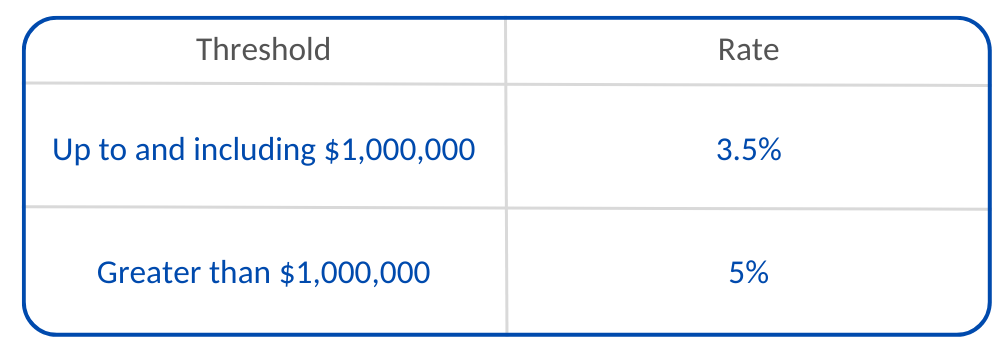

In a technical briefing following the 2022 Budget presentation, the Department of Finance confirmed that the new DQ rate would be applied as a graduated rate, with the current rate of 3.5% applying to a charity’s property not used in charitable activities or administration up to $1 million, and the rate of 5% applying to any such property exceeding the $1 million threshold. The proposed changes will apply to charities in respect of their fiscal periods starting on or after January 1, 2023.

What are the practical implications?

If your family foundation has capital of $1,000,000, then under the new rules, it must give away at least 3.5% or $35,000 each year to other charities. If your family foundation has $10,000,000, then it must give away $485,000 each year. The charity is required to give away 3.5% on the first $1 million ($35,000), and then 5% on the next $9 million ($450,000).

Family foundations may choose to give away more than the minimum DQ requirement, and many do. But, foundations should also consider this new DQ requirement when making investment plans. To be sustainable and grow capital under the new rules, an investment portfolio must return at least 5% to avoid spending its endowment or encroaching on its capital. This may be difficult in low rate environments or periods of economic recession.

What to expect next?

Some are saying the DQ should be raised to 10% annually. This will result in many charitable foundations simply getting smaller each year as many investment portfolios do not generate this rate of annual return.

Others are calling for specific rules that target Donor Advised Funds (DAFs). They argue that many DAFs are sitting on large pools of capital that are not flowing to qualified donees. Many donors using DAFs are flowing their donation through the DAF for a variety of reasons. These reasons include remaining anonymous to the charities they support. Reasons could also include using the DAF to provide administrative support for such donations as appreciated securities). This results in large disbursements which are a credit to a DAF’s overall DQ. While other donors using DAFs are parking their capital inside DAFs for extended periods and not making any disbursement.

Many DAFs do not require all donors to meet a DQ requirement. This is because the DAF overall can meet the legal requirement anyway. The result of this behaviour is a wide variation between individual DAF accounts. Overall, DAFs far exceed the DQ requirement but also include accounts that do not make any disbursements at all.

Your family office

Successfully managing a family foundation includes staying on top of the tax rules for charities, making plans to exceed minimum thresholds, and keeping good books and records to support compliance. Our family office has experience managing family foundations. We can show you the pros and cons of creating your own family foundation compared to other vehicles for philanthropy including donor advised funds. We can also help you manage your foundation in a way that helps you maximize your charitable impact and focuses your time on the tasks where you gain the greatest fulfillment.

Comment (1)

[…] Update on the Disbursement Quota. […]

Comments are closed.