Unsurprisingly, the Canada Revenue Agency (CRA) demands taxes be paid in Canadian dollars. This is simple enough when you earn income in Canada, since you were likely paid in Canadian dollars anyway. Your Canadian based investments are also likely quoted in Canadian dollars, which makes reporting your investment income based in Canada simple as well.

But, what happens when you make investments outside of Canada? What extra bookkeeping should you do when you pay for an investment in a foreign currency and receive the proceeds from the sale that currency?

Every Canadian must report their worldwide income to CRA. Therefore, if you make an investment outside of Canada using foreign currency, the gains or losses from that investment must be reported to CRA in Canadian dollars. This requires you to keep track of the Canadian dollar value of a foreign currency investment when it was bought and sold.

When assets, including investments, are purchased or sold the exchange rate in effect on the date of the transaction should be used. Dividends received throughout the year can be converted at either the transaction date rate or the average annual exchange rate for the taxation year, but the method used should be consistent from year to year.

You can look up historical rates on Bank of Canada’s website.

Foreign dividend reporting to CRA

Let’s say you invest in US stocks. If you buy shares in Microsoft with US dollars and receive dividends in US dollars, you’ll need to apply an exchange rate to those dividends each year to report to CRA. When you earn dividend income in foreign currency throughout the year, you should apply the average exchange rate for the year to those foreign dividends.

In this case, if you receive $10,000 USD of dividends from Microsoft in a year and the average exchange rate for the year was 1.25, then the foreign income (dividends) you should report to CRA is ($10,000 * 1.25) = $12,500 Canadian dollars. Your Canadian broker will provide you with a T-slip that summarizes this income for you, including any withholding taxes that you already paid.

In the case of dividends from US publicly listed stocks, your Canadian broker will withhold a portion of your dividends for the Internal Revenue Agency (IRS). A tax treaty between Canada and the US generally allows Canadians to claim this tax withheld against the Canadian tax they would otherwise owe (to prevent double taxation). However, all reporting to CRA is still required.

Reporting capital gains or losses

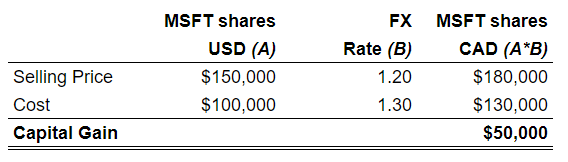

When you eventually sell your shares in Microsoft, you’ll also need to report those capital gains or losses to CRA in their Canadian dollar value. This means you should subtract the cost base of those shares in CAD from their proceeds in CAD to arrive at your capital gain or loss.

For example, if you purchased $100,000 USD worth of Microsoft shares when the Canadian dollar exchange rate was 1.30, then your cost base in CAD is $130,000. If you sell those shares for $150,000 USD when the Canadian dollar exchange rate is 1.20, then the proceeds from your sale in CAD is $180,000, giving you a capital gain of $50,000 CAD.

It doesn’t matter if the sale proceeds stay in U.S. dollars or get converted back into Canadian dollars in your brokerage account. US dollar proceeds, even if retained in US dollars, must still be reported to CRA in Canadian dollars terms.

Bookkeeping Strategies for Easy Reporting

Ideally, you should keep track of the applicable exchange rates on your purchases of US or foreign currency denominated investments. Your Canadian broker won’t necessarily keep the Canadian dollar cost base of the US listed stocks in your USD brokerage account, so you must do this bookkeeping on your own. Your accountant and/or your family office can do this for you.

Organized investors usually keep track of the Canadian dollar cost base of their foreign investments in two different ways. If trades are less frequent, then some investors keep a spreadsheet of the dates and the amounts transactions were made for. Some investors using this method also use accounting software to keep track of like investments inside a bulk account such as “US marketable securities” for US stocks. When a stock is purchased, in an accounting software, a debit to the US marketable securities account is made and credit to the appropriate cash account. In the background, an update is also made to the spreadsheet of cost bases so there are parallel records.

Alternatively, investors could also keep a separate bookkeeping account for each foreign investment made and then credit or debit the account using a bookkeeping software as transactions happen. The purchases or sales could be recorded with their Canadian dollar equivalent and an exchange rate noted in the transaction description.

Markdale Way

From our experience, keeping a separate ledger in a spreadsheet with a list of transactions of foreign currency denominated investments is the best practice for keeping track of the cost base of such investments. This record keeping method is easy to reconcile with an online accounting software, with limited adjusting entries.

Our family office works with accountants to implement a bookkeeping process that will ensure that proper records are kept, and that reports can be generated in a timely manner. Please get in touch with us to learn more about how we help wealthy families manage their tax compliance requirements and reporting preferences.