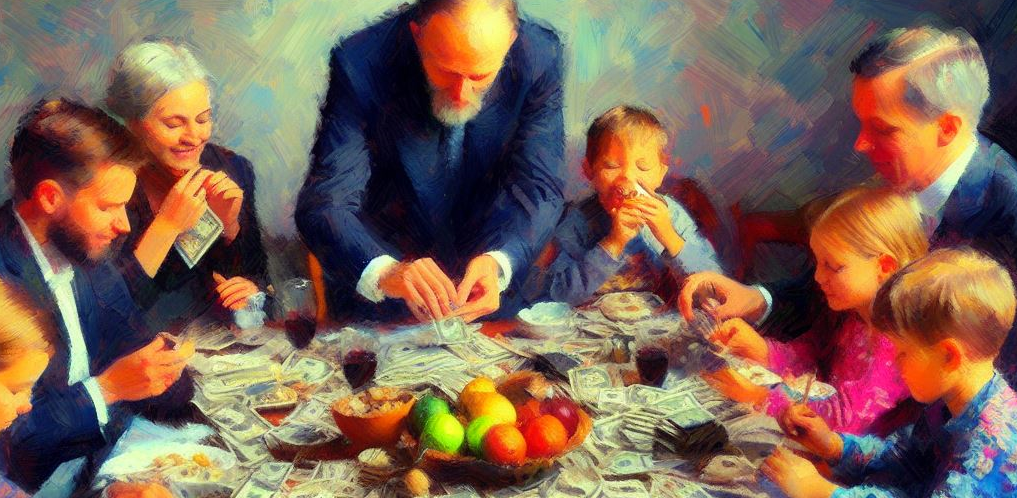

Within wealth management, family meetings have emerged as a valuable tool for generational wealth transfer. Through our family office, we’ve seen a growing number of clients harness the power of family meetings to prepare their next generation for the responsibilities and opportunities that lie ahead. Here’s how and why these gatherings are transforming the wealth management landscape.

Before we begin, let’s put your financial knowledge to the test. Try out our free financial literacy quiz and see how you stack up!

What Are Family Meetings?

Family meetings in the context of wealth management are structured discussions where members come together to discuss financial matters, from basic education to in-depth strategizing. These meetings evolve from foundational financial knowledge to values-based conversations and skill-building sessions.

Why Are Family Meetings Beneficial?

- Knowledge: they enable sharing financial insights and strategies with the next generation and allow them to gain the knowledge and experience they will need to take responsibility over-time.

- Accountability: they encourage responsible financial behaviour because they promote decisions that can withstand the spotlight (of future meetings).

- Mentorship: they allow experienced family members to guide younger family members.

- Succession: they support a smooth transition of wealth and responsibility over-time.

- Transparency: they create a safe and structured environment for wealth management discussions.

Challenges to Overcome

Despite their benefits, many hesitate to conduct family meetings. Why?

- Power & Control: the shift towards shared decision-making is uncomfortable for those accustomed to exclusive control.

- Overconfidence: successful entrepreneurs often fall prey to overconfidence, extending this mindset to areas outside their expertise, such as wealth management. This cognitive bias can create significant obstacles to successful generational wealth transfer.

- Vulnerability: discussing financial mistakes or confronting the reality of mortality requires a level of vulnerability that many are not comfortable with. For wealth creators, admitting past errors in financial judgment during a family meeting can be a blow to their self-image and authority within the family.

Tips for Making Family Meetings Work

- Choose a Comfortable Setting: choose a setting that reflects the family’s style and values, whether it’s a cottage retreat or a formal boardroom.

- Create a Structured Agenda: distribute a well-thought-out agenda beforehand to allow for preparation and input.

- Conduct on a Consistent Schedule: regular meetings support ongoing engagement and progress.

- Leverage Professional Facilitation: a neutral facilitator can keep discussions on track, manage dynamics, and ensure everyone’s voice is heard.

- Include Patience and Tolerance: approach each meeting with a mindset of respect and understanding.

How a Family Office Can Help

- Preparation: a family office can generate quarterly reports that will set the stage for fruitful discussions. And, also canvas family members for topics they want on the agenda.

- Scheduling: a family office will co-ordinate with family members to ensure a time & place that is suitable for everyone.

- Agenda Crafting: a family office will create tailored agendas to ensure productive meetings.

- Professional Facilitation: From setting selection to guiding discussions, a family office will ensure your meetings are positive and constructive.

- Fun and Bonding: family meetings should also celebrate success and strengthen familial bonds. A family office can support a positive atmosphere.

At Markdale Financial Management, our role as a family office in facilitating family meetings extends beyond mere organization. We act as partners, educators, and mediators, committed to fostering an environment where your family’s wealth and values can be discussed openly, planned thoughtfully, and passed down to future generations effectively. Our goal is to ensure that discussions are not only productive in terms of wealth management but also enriching in terms of family dynamics and legacy building.

If you are interested in joining our network, contact us or fill out this free assessment questionnaire to determine if our family office services can help you efficiently manage your wealth!