The wealth management industry has become increasingly sophisticated when selling us financial services. They come up with “holistic solutions” to our financial “problems” and tap into our emotions in an effort convince us to pay them.

The truth is, like most important things in life, there is no “quick fix” to managing our finances and you can’t simply buy success off the shelf.

Successfully managing your wealth means developing clear repeatable processes that you refine quarter by quarter, year by year, just like running a successful business. I call this business plan for your finances a Wealth Management Process. It includes your Investment Policy, and the way you review your finances and make financial decisions.

This post considers how a family office will support the development of your Wealth Management Process.

What is Wealth Management?

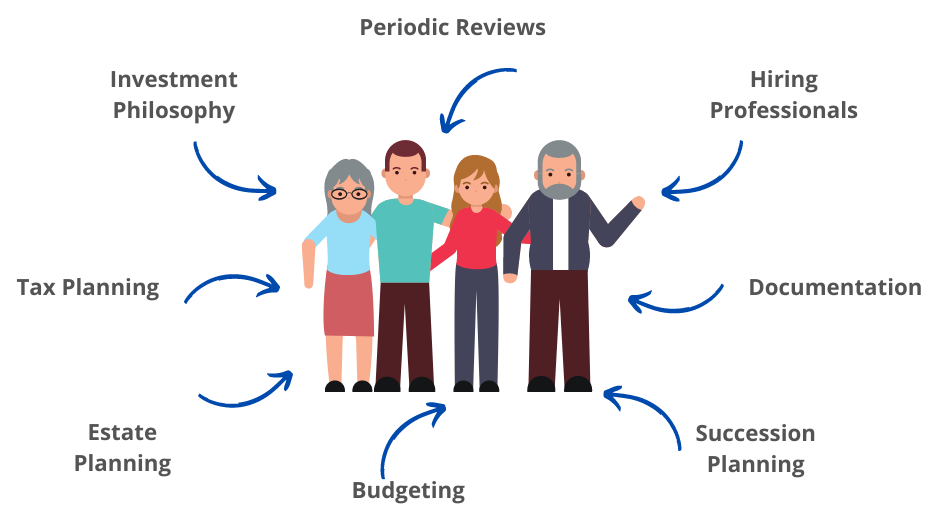

Wealth management begins with explicitly identifying your family values, and being clear about what your financial and investment goals are. This is often done by making a financial plan and writing an investment policy. Your financial plan may include a budget. It may also include a schedule of tasks that need to be done at regular periods. For example, how do you file your taxes? Using an accountant? Who is that? How do you interact with your accountant? What about holdcos and your foundation, how do they file their tax returns?

Just because you’ve been doing it the same way for many years don’t assume your kids will know how to do the same things automatically. Document your process. This is what your Wealth Management Process aims to do: document and refine the way you manage your wealth.

What is your current Wealth Management Process?

Begin by documenting how you currently manage your finances. What are your values? Why are you investing? How do you budget and what is your budget? How do you invest? How do you file your taxes? How do you manage your philanthropy? Etc.

Write down your current way of managing your wealth in point form on a page (or get your family office to do this for you). That’s the first version of your Wealth Management Process.

Week by week, refine your Wealth Management Process so it gets better. If what I’m describing already seems like a lot of work (and no fun), this is where a family office can help.

A family office will do all the work it takes to implement your Wealth Management Process. Your family office will refine your Wealth Management Process over time and document how you operate along the way. Like your personal CFO.

Taking it to the next level.

When your wealth is large enough that you can’t (or shouldn’t) consume it all yourself, then you need to think about more than just dollars and cents. Enlightened wealthy families think in deep time about the financial impact they will leave on the world around them including how they will transition wealth to future generations. Because wealth management becomes even more important when your wealth exceeds your ability (or desire) to consume it yourself.

The greatest accomplishments in life take time and effort to undertake. Whether you like it or not, managing your wealth successfully is one of life’s accomplishments.

What do financial advisors tell us to do?

When I Google “wealth management process”, I’m presented with abstract descriptions of how financial advisors help their clients. Their process usually begins with some sort of “discovery” stage where the financial advisor will learn about your situation, goals, etc. Then most financial advisors will craft some sort of plan they will implement for you.

Objectively, this is good. Planning is smart, but often, this “plan” is simply a menu of services you can purchase from the financial advisor.

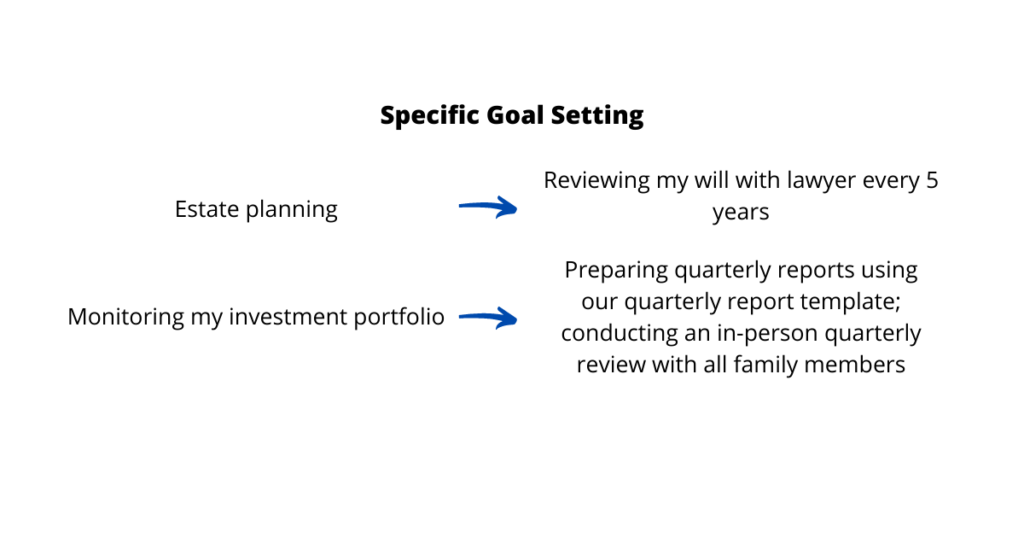

Implementing a financial plan means doing specific things, not paying investment management fees or buying life insurance.

“Master of your own domain”

What I’m getting at is that when you’re wealthy, you should be in control of your own unique wealth management process. Your accountant, investment advisor, lawyer, and family office should all be supporting you by doing the work required to undertake your process. Your advisors need to be plugged into your machine, not you into theirs.

Each task in your Wealth Management Process should include who is responsible for doing the work, how it will be done, etc., just like a business will document its operating procedures.

Everchanging, Everlasting

Over time, your Wealth Management Process will become more refined and better tailored to your needs. As your family grows and ages, and new members are born and reach adulthood, your Wealth Management Process will also change, and adapt to those changing circumstances.

Eventually, you’ll need to transition your wealth to the next generation (even when philanthropic).

Imagine if you were to attempt selling a business but hadn’t documented how the business is run. Imagine if your business operations were just inside your head. I’ve seen this happen many times to entrepreneurs, and they soon learn their business isn’t worth much to an outside investor until they can document the way their business works.

I’ve also watched wealthy families struggle with transitioning their wealth to future generations because they neglected to document their Wealth Management Process and teach their kids how to implement it. They leave a pile of money to their kids, who often feel guilty and burdened by the wealth (or blow it frivolously). Without guidance and experience managing wealth, it makes heirs more vulnerable to being swindled by advisors or bled out by fees.

Documentation Matters

Apply this principle to how you manage your wealth. Documentation matters. Does your Wealth Management Process have any documented operating procedures?

It becomes a lot tougher to transition your wealth to future generations when all your knowledge and experience dies with you.

If you’ve refined and documented your Wealth Management Process over time, then your heirs won’t need a financial advisor to provide them with one. Instead, your heirs will use financial advisors or a family office to undertake the work your Wealth Management Process demands.

Who owns your plan? You or your financial advisor?

This distinction is important because when you buy someone else’s advice, you are buying into their control. You are in control only when you have a plan of your own.

When you buy services from a financial advisor, are you buying into their process or are they supporting the development of your own?

How does your Wealth Management Process use the services of your team of professional advisors?

Let’s say you’ve decided that managing your investment portfolio is too time consuming, uninteresting, or scary for you. So, you use an investment advisor. This is a perfectly reasonable choice. But you need to take outsourcing this task a step further.

Since you’ve decided to use an investment advisor as part of your Wealth Management Process, be explicit about why, and demand your investment advisor give you a standard level of service. Agree to a list of tasks your investment advisor will perform for you.

Such a task list might include:

- Quarterly report of your portfolio

- Quarterly review (e-mail or phone, etc) of your portfolio

- Send you an organized tax package each year so you can file tax returns (how, when, for what?)

- Provide you with other recommendations relating to topics such as estate planning, insurance planning etc

What about a Family Office?

Your family office should be built to serve your needs first. The methods that your family office applies are ones set out in the plan they have customized specifically for you.

How is your Wealth Management Process implemented?

Your family office should do the day-to-day grunt work including connecting and following up with your team of professional advisors so that you can focus your time and energy on the areas of your life where you can make the biggest impact.

Each of us has our own unique perspective, including things that we are good at, and things that we are bad at. Wealthy families gain perspective when they understand that outsourcing administrative tasks to their family office is a good way to free up their time to focus on the most important things in their life.

This approach to managing wealth is what makes a family office such a valuable part of your Wealth Management Process when you can afford it. Scale can be achieved by using a family office because administration can be outsourced to it, and the weight can then fall off your shoulders.

Your Wealth Management Process is not set in stone.

The way we manage wealth changes over time. In prior generations, keeping good records might involve a paper ledger of transactions stored in a file cabinet. Today, we might use spreadsheets stored on a shared drive in the cloud. In the future, these records might be stored on blockchains.

Your Wealth Management Process needs to adapt to changing times and is a way to avoid shooting from the hip.

Wealth is not just money.

Successfully managing your wealth means creating a repeatable process based on core values that can be passed down to future generations. It will never be perfect so be willing to continuously refine and improve your process.

Take the creation of your Wealth Management Process seriously and find professional advisors that will support the development of yours.

If you’re interested in developing and refining your own Wealth Management Process, please get in touch with our family office so we can share our experience with you.