Essentially, a family office is like your personal CFO. A family office does all the tasks that your accountant, your investment advisors, your lawyer, and your bankers won’t do.

My clients tell me I’m like their Consigliere. A consigliere is a close, trusted advisor and confidant, or a kind of “right hand man”. I jokingly describe that my family office service is about “knowing where all the dead bodies are buried”. This means I make a lifelong commitment to my clients and I’m loyal to their family above all else.

It helps to have a person leading your family office who’s wealthy themselves. Because being a good consigliere is not done for profit, but for honor. Talking about payment for a family office service centers on what’s fair instead of what is profitable.

This type of approach is much different from a wealthy person’s other service providers. Because most, if not all, service providers may only have contractual loyalty to their clients.

What specifically does a family office do? This post describes a few of the most valuable things that we do for our clients.

First, the Bat Phone.

Have you ever tried calling your bank to solve a problem or ask a question and were put on hold? Obviously, you have, and waiting on hold can be very frustrating.

One of the services my family office provides is what I call “the Bat Phone”. This means that my clients can call me anytime day or night and I will pick up my phone. I’ve learned the only times I cannot fulfill this commitment is when I’m either on a plane or in a subway.

The Bat Phone is a very powerful service. For clients, it means they can always reach someone credible who can solve their problem at any time. The Bat Phone means clients never have to speak to a newbie underling who doesn’t understand their situation. It means my clients don’t have to explain themselves to anyone. They must simply express what it is they want to happen, and I’ll get it done.

The Bat Phone is a valuable luxury for my clients. Having someone capable on standby who can solve any financial problem at the “drop of a hat” is something only wealthy people can afford.

Where else do I add value? Consolidated reporting.

Each investment advisor will provide account statements to their clients showing them the value of their accounts and returns. But investment advisors cannot provide you with a regular report customized specifically for you showing you your entire net worth described in a way you prefer.

Consolidated reporting is what a family office should do.

Creating consolidated reports of my client’s wealth means showing them their wealth in a way that is easy for them to understand and gives them a “big picture” illustration of their financial life. This might be done using a pie chart showing my client’s their asset allocation or a table listing the value of specific assets.

I’ve been told by clients many times that my consolidated reports add clarity and simplicity to their financial lives.

What about Documentation?

We live in a world of burdensome compliance. The tax system is complicated and requires detailed record keeping. Your accountant can be a big help, but your accountant can’t do all things. For example, will your accountant fill out new account application forms for you? If not, then unless you want to spend hours preparing documents for a new account application yourself, the information needs to be accessible to someone who will. This is what a family office can do. Document your financial life in a secured but accessible way and use this information to fill out forms and file forms on your behalf.

I recently filled out an investment account application for a client with a Canadian custodian and the form package was 55 pages long. I read the entire package of forms and filled out the appropriate sections. It took several hours, but this was time my client didn’t have to spend doing it themselves.

Another time, a client received a distribution of public stock from a private equity fund they invested in which required an account to be opened with an American investment bank to receive the shares. The account opening process took over 4 months! I kept going back and forth with the American bank until all their demands where met. I guess they had less experience holding an account for a Canadian based holding company. Managing this process is something your family office can do.

As a wealthy person, the last thing you want to do is fill out forms.

How about being a Sounding Board?

Sometimes you just need to talk it out. When big decisions need to be made, its nice to have someone in your life who you can trust and confide in but who also has experience in sophisticated financial matters.

Oftentimes, my clients find it valuable to describe their thought process to me, so I can offer them support, feedback, and guidance. Many times, I can suggest alternative perspectives or better ways of doing certain things that they might not have considered.

A good sounding board is very valuable when the financial stakes are high.

As someone who’s worked with wealthy people for almost two decades, I have experience with many different financial arrangements and tasks. Everything from sophisticated estate planning, to investing, to tax compliance, I generally have the answers (or can find them).

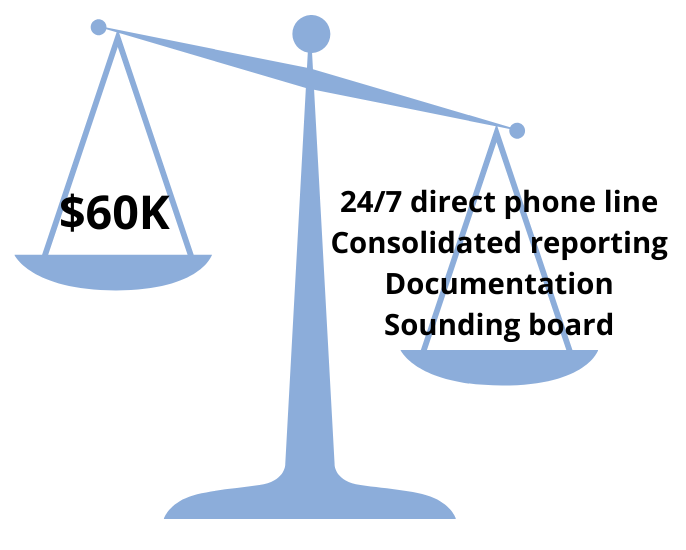

But what does it cost?

Think about the cost of a family office from both perspectives: the client and the family office. Also consider the complexity of the financial lives of the clients. Each client situation is different. So, each client requires a customized level of service that meets their individual objectives.

Some wealthy families have a few holding companies, multiple properties, active stock portfolios, charitable foundations, and private businesses. Other families simply have a portfolio of blue-chip stocks with their own home & cottage.

How my clients use my family office depends on the objectives they are trying to achieve and the level of activity they are undertaking to achieve those objectives.

Add it all up

The family office service I’m describing is expensive to deliver. It requires a highly capable team who has experience in many different financial areas. A family office is also more valuable to the client as the complexity of their financial life grows and their wealth grows larger. This is because the more complex someone’s financial life is, the more work there is to do. If their wealth grows larger, the stakes grow larger as well.

Let’s say you’re someone with a net worth of $100,000,000 invested in a portfolio of blue-chip stocks. The dividend yield of your portfolio is 2.5%, which means your portfolio generates $2.5 million of cash per year. If your portfolio grows by 10% in one year, this means an increase of $10 million. Is it worth it to have someone in your corner providing you with family office services? If this service costs $60,000 per year, is it a good value?

Take our Assessment Questionnaire to evaluate your readiness and receive personalized tips from us.